Crypto NEWS

Today in Crypto: XRP Overtakes Solana, NFTs Surge, and SEC Targets Touzi Capital

XRP Flips Solana’s Market Cap to Reclaim 4th Spot

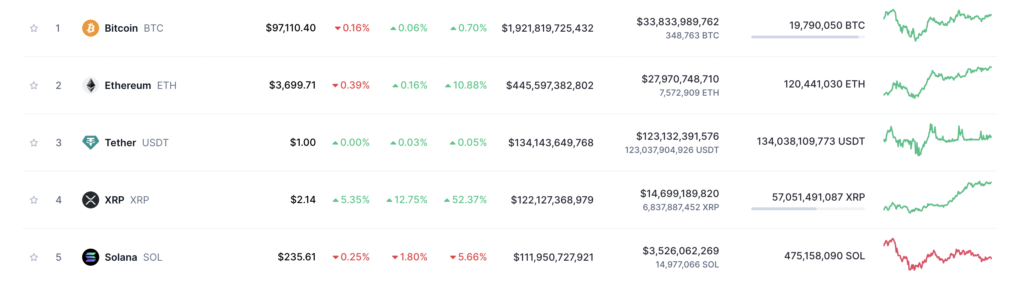

Ripple’s XRP has achieved a major milestone by surpassing Solana (SOL) in market capitalization. As of December 1, 2024, XRP is now the fourth-largest cryptocurrency, trailing only Bitcoin, Ethereum, and Tether.

According to CoinMarketCap, XRP’s market cap surged to an impressive $122 billion, compared to Solana’s $111.9 billion. This rally marks XRP’s highest price levels in seven years, with the token reaching $2.19 in late November.

What’s Driving XRP’s Rally?

Several factors have propelled XRP’s dramatic rise:

Strategic Partnerships: Ripple Labs has recently inked high-profile partnerships with global institutions, boosting confidence in the ecosystem.

ETF Hopes: Speculation around the approval of an XRP exchange-traded fund (ETF) in the United States has fueled investor optimism.

Stablecoin Approval: Ripple’s RLUSD stablecoin is likely to receive approval from the New York Department of Financial Services (NYDFS), further legitimizing the network.

The rally signals a renewed appetite for XRP, as Ripple continues to expand its influence in blockchain-based payment systems.

NFTs Rebound: November Sales Hit $562 Million

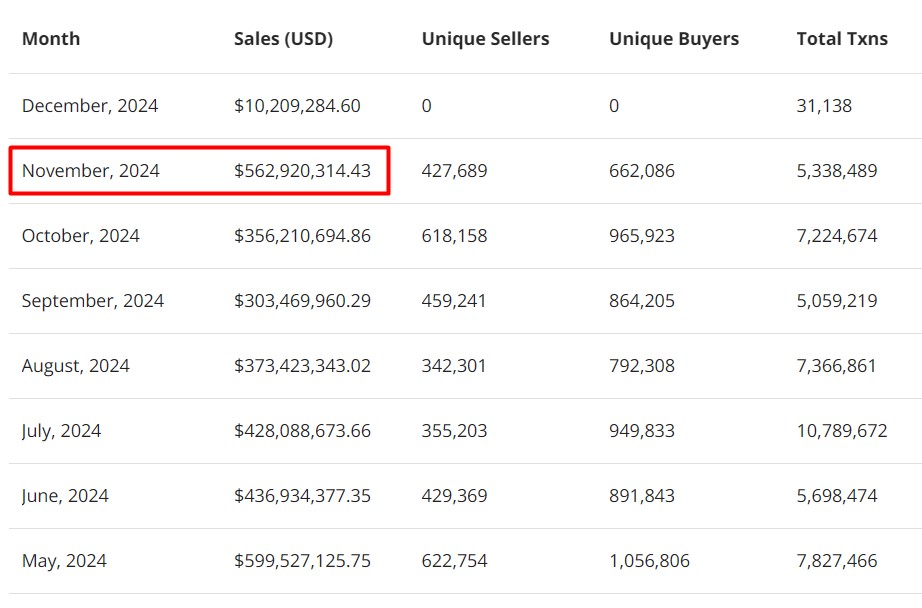

The non-fungible token (NFT) market is showing strong signs of recovery, recording a six-month high in sales volumes. According to CryptoSlam, NFTs generated over $562 million in sales during November 2024, a significant leap from October’s $356 million.

Digital Collectibles Regain Momentum

This resurgence brings November’s sales to their highest level since May, when monthly NFT volumes reached $599 million. Popular collections like CryptoPunks have led the charge, with their floor price climbing from 26.3 ETH ($97,800) at the start of the month to 39.7 ETH ($147,000) by November 30.

While sales are still far from their March peak of $1.6 billion, the renewed activity suggests growing interest in NFTs, buoyed by broader crypto market gains.

SEC Sues Touzi Capital Over Alleged Fraud

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against investment firm Touzi Capital, accusing it of defrauding over 1,200 investors. The firm allegedly raised nearly $95 million under false pretenses, pitching a fraudulent crypto asset mining fund.

Allegations of Deception

The SEC claims Touzi Capital misrepresented the liquidity and profitability of its fund while diverting investor money into unrelated ventures.

Commingled Funds: Instead of using the money for mining operations, Touzi reportedly pooled funds across its subsidiaries for non-crypto-related purposes.

Misleading Claims: Investors were told these products were as safe as high-yield money market accounts, which the SEC argues is materially false.

This case adds to a string of recent enforcement actions by the SEC as regulators continue to crack down on misconduct in the crypto sector.

Closing Thoughts

Today’s developments highlight the volatility and rapid pace of change in crypto markets. From XRP’s historic rally and NFTs’ resurgence to the SEC’s crackdown on bad actors, the crypto ecosystem continues to evolve with opportunities and risks alike.

Investors should stay vigilant, focusing on fundamentals while keeping an eye on regulatory developments shaping the future of blockchain and digital assets.