Finance

Why Dollar Mutual Funds Are Your Best Bet for Growing Wealth in Dollars

Escape Naira Depreciation and Grow Your Wealth

Imagine this: you’ve worked hard to save in dollars, hoping to shield your money from Nigeria’s unpredictable inflation and Naira depreciation. But then you realize your dollars are just sitting in a domiciliary account, barely earning anything—or worse, losing value to bank charges. Frustrating, right? What if there was a smarter, low-risk way to grow your dollars while keeping them safe? Enter dollar mutual funds, a powerful investment option that’s gaining traction among Nigerians at home and abroad.

In this article, we’ll explore why dollar mutual funds, particularly the Stanbic IBTC Dollar Mutual Fund, are one of the best ways to secure and grow your wealth in dollars. From protecting your money against Naira volatility to earning stable returns, we’ll break down everything you need to know in a simple, relatable way. Whether you’re an entrepreneur, freelancer, or just someone saving for a big goal like school fees or relocation, this guide will show you how to make your dollars work harder for you. Let’s dive in!

What Are Dollar Mutual Funds?

Dollar mutual funds are investment vehicles that pool money from multiple investors to generate returns in dollars. Unlike keeping cash in a domiciliary account or stashing it at home, these funds are managed by professional financial experts who invest in low-risk, dollar-based assets like Euro bonds and fixed-income securities. The goal? To deliver steady, passive income while preserving your wealth in a strong currency.

How Do Dollar Mutual Funds Work?

- Pooled Investments: Your money is combined with other investors’ funds, giving you access to high-quality investments you might not afford alone.

- Professional Management: Experts handle the investment decisions, so you don’t need to be a finance guru to benefit.

- Dollar-Based Returns: Earnings are in dollars, protecting you from Naira depreciation and currency fluctuations.

- Low-Risk Focus: Most dollar mutual funds prioritize stable assets, making them safer than volatile options like stocks or crypto.

For Nigerians, dollar mutual funds are a game-changer because they offer a way to grow your money in dollars, not just save it. The Stanbic IBTC Dollar Mutual Fund, for example, is a popular choice due to its strong track record and accessibility, which we’ll explore later.

Want to learn more about mutual funds in general? Check out our guide on Understanding Mutual Funds for a beginner-friendly overview.

Why Invest in Dollar Mutual Funds?

If you’re still saving in Naira or letting your dollars sit idle, you’re missing out on a huge opportunity. Dollar mutual funds offer compelling benefits that make them a smart choice for anyone looking to protect and grow their wealth. Here are the top reasons to consider them:

1. Protect Against Naira Depreciation

The Naira’s value can be a rollercoaster, losing value almost daily due to inflation and economic instability. By investing in dollar mutual funds, you’re shielding your wealth from this volatility. Your money grows in dollars—a globally stable currency—ensuring your purchasing power stays intact.

2. Earn Passive Income in Dollars

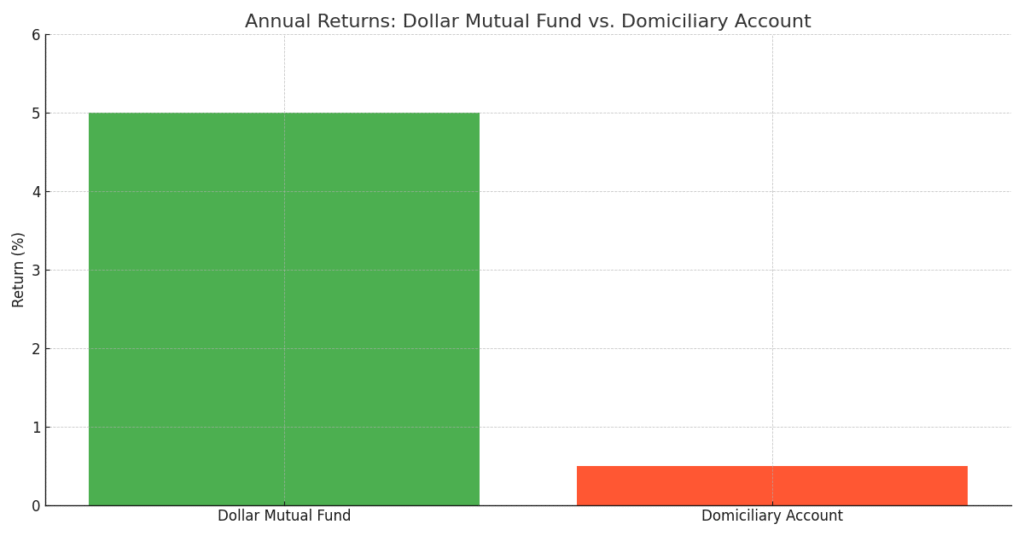

Unlike domiciliary accounts that pay negligible interest (and still charge fees!), dollar mutual funds generate meaningful returns. For instance, the Stanbic IBTC Dollar Mutual Fund has historically delivered around 5–7% annual returns, paid quarterly. That’s money working for you while you sleep!

3. Low-Risk Investment

If the thought of stocks or cryptocurrency makes you nervous, dollar mutual funds are a safer alternative. They focus on stable, high-quality assets like Euro bonds, which offer predictable returns with minimal risk. It’s an ideal option for conservative investors or beginners.

4. Perfect for Big Savings Goals

Planning to pay school fees abroad, relocate, or fund a major purchase? Dollar mutual funds let you save in dollars while earning returns, helping you reach your goals faster. The minimum investment is often affordable (e.g., $100 for Stanbic IBTC), making it accessible for many.

Curious about other ways to save in dollars? Explore our post on Dollar Savings Strategies for Nigerians for more tips.

Figure 1: Annual returns of dollar mutual funds (~5%) vs. domiciliary accounts (~0.5%). Dollar mutual funds offer significantly higher growth potential.

Is the Stanbic IBTC Dollar Mutual Fund Safe?

When it comes to investing, safety is a top concern. The good news? The Stanbic IBTC Dollar Mutual Fund is a reliable and secure option for growing your wealth in dollars. Here’s why:

Backed by a Trusted Institution

Stanbic IBTC Asset Management is a well-established financial institution in Nigeria with a strong track record. Regulated by the Securities and Exchange Commission (SEC), the fund operates with transparency and adheres to strict guidelines, giving you peace of mind.

High-Quality Investments

The Stanbic IBTC Dollar Mutual Fund primarily invests in Euro bonds—high-quality, dollar-denominated securities issued by reputable organizations. These assets are designed to generate stable returns, minimizing the risk of loss.

Proven Track Record

Over the past five years, the fund has consistently delivered annual returns of around 5–7%, far surpassing the negligible interest offered by domiciliary accounts. While returns aren’t guaranteed, this historical performance shows reliability.

Compared to keeping your dollars in a domiciliary account (where you might earn 0.5% or less), the Stanbic IBTC Dollar Mutual Fund is a clear winner for wealth preservation and growth. For more on safe investments, see our article on Low-Risk Investment Options in Nigeria.

How to Get Started with Dollar Mutual Funds

Ready to make your dollars work harder? Getting started with the Stanbic IBTC Dollar Mutual Fund is straightforward and can be done from the comfort of your home, whether you’re in Nigeria or abroad. Here’s how:

Step-by-Step Guide

- Open an Investment Account: Visit the Stanbic IBTC Asset Management website (www.stanbicibtcfunds.com) and register for an account. The process is fully online.

- Fund Your Account: Start with a minimum investment of $100. You can add more funds later, but each additional contribution must be at least $100.

- Choose the Dollar Mutual Fund: Select the Stanbic IBTC Dollar Mutual Fund from the available options.

- Watch Your Money Grow: Returns are paid quarterly (every three months), and you can track your investment online.

Reinvesting for Growth

To maximize your returns, consider reinvesting your quarterly payouts back into the fund. This allows your money to compound, earning interest on interest over time.

New to investing? Our guide on How to Start Investing in Nigeria walks you through the basics.

What’s the Catch?

No investment is perfect, and dollar mutual funds are no exception. While the Stanbic IBTC Dollar Mutual Fund offers compelling benefits, here are a few things to keep in mind:

1. Returns Aren’t Guaranteed

While the fund has historically delivered 5–7% annually, returns can fluctuate based on market conditions. However, its focus on low-risk assets minimizes significant losses.

2. Limited Liquidity

Your money is locked in for the first 182 days (about six months). If you withdraw early, you may lose part of your interest. After this period, withdrawals take up to two working days—not as instant as a bank transfer.

3. Long-Term Commitment

Dollar mutual funds shine over the long term (5–10 years). If you’re looking for quick cash, this isn’t the right fit. Patience is key to unlocking the full potential of your investment.

Despite these drawbacks, the Stanbic IBTC Dollar Mutual Fund remains one of the best low-risk, high-return options for Nigerians looking to grow their wealth in dollars.

Tips to Maximize Your Dollar Mutual Fund Investment

To get the most out of your dollar mutual fund, follow these strategies:

- Reinvest Your Returns: Instead of cashing out quarterly payouts, reinvest them to benefit from compound growth.

- Adopt a Long-Term Perspective: Stay committed for 5–10 years to see significant wealth accumulation.

- Diversify Your Portfolio: Combine dollar mutual funds with other dollar-based investments, like Treasury bills, for added security. Learn more in our post on Diversifying Investments in Nigeria.

- Stay Informed: Keep an eye on market trends and consult a financial advisor to ensure your investment aligns with your goals.

Frequently Asked Questions

Are dollar mutual funds safe?

Yes, funds like the Stanbic IBTC Dollar Mutual Fund are safe, backed by SEC regulation and investments in high-quality Euro bonds. However, returns aren’t guaranteed and can fluctuate.

How much can I invest in the Stanbic IBTC Dollar Mutual Fund?

The minimum investment is $100, with additional contributions starting at $100.

How often are returns paid?

Returns are paid quarterly (every three months), either in cash or reinvested for compound growth.

Can I withdraw my money anytime?

After the initial 182-day lock-in period, you can withdraw with up to two working days’ processing time. Early withdrawals may incur interest penalties.

Who should invest in dollar mutual funds?

They’re ideal for Nigerians saving for big goals (e.g., school fees, relocation), entrepreneurs, freelancers earning in dollars, or anyone seeking low-risk dollar-based growth.

Take Control of Your Financial Future

Dollar mutual funds, like the Stanbic IBTC Dollar Mutual Fund, offer a powerful way to protect your wealth from Naira depreciation and grow your money in a stable currency. With low-risk investments, professional management, and steady returns of around 5–7% annually, this is a smart choice for Nigerians at home and abroad. Whether you’re saving for a big goal or building long-term wealth, dollar mutual funds let your money work harder for you.

Don’t let your dollars sit idle in a domiciliary account or under your mattress. Take the first step today by exploring the Stanbic IBTC Dollar Mutual Fund or consulting a financial advisor to create a plan that works for you. Your financial future is in your hands—make it count!

Ready to start?

Visit Stanbic IBTC Asset Management to open your account, or check out our Beginner’s Guide to Investing for more inspiration.