Crypto NEWS

“Stagflation Could Crush Bitcoin in 2025: Here’s What Investors Need to Know!”

Stagflation Concerns Loom Large Over Bitcoin’s Price Projections for 2025

As Bitcoin approaches a crucial phase in its bull market, economic uncertainty casts a long shadow over price forecasts for 2025. With initial jobless claims set to be released on January 2nd, all eyes are on the Federal Reserve’s response to ongoing inflation concerns. Yet, it’s the looming threat of stagflation that is really making investors uneasy.

Stagflation: The Elephant in the Room

In a recent post from the Kobeissi Letter, it was noted that investors are growing increasingly concerned about a potential repeat of the 1970s inflationary environment. The fear? That the U.S. Federal Reserve will cut rates in response to a weakening labor market, even as inflation continues to rise.

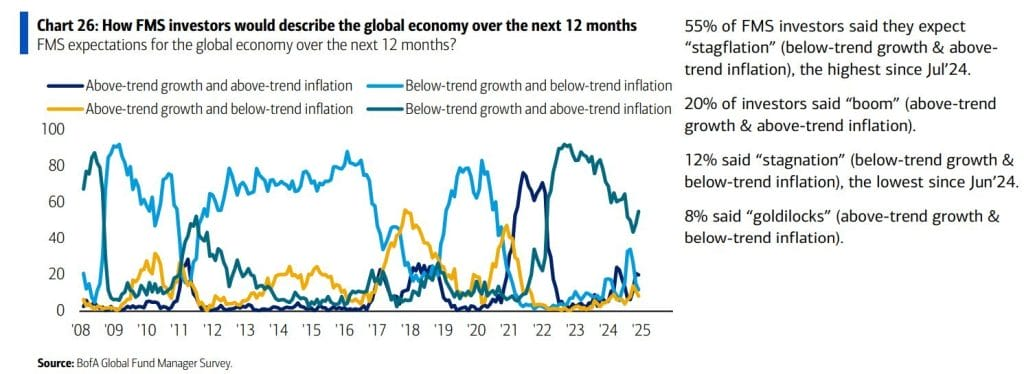

Markets have already priced out the likelihood of further rate cuts in 2025, and many are bracing for the arrival of stagflation—a period marked by high inflation and stagnant economic growth. According to the Kobeissi Letter, the beginning of stagflation is already upon us, with inflation possibly surpassing 4% next year. Yet, the Federal Reserve has yet to fully acknowledge this risk, which could have profound implications for Bitcoin’s future.

What Does Stagflation Mean for Bitcoin?

Historically, Bitcoin has been viewed as a hedge against inflation, an asset that could protect against the erosion of purchasing power typically caused by rising prices. However, the correlation between Bitcoin and traditional markets—and its sensitivity to broader macroeconomic conditions—introduces a layer of complexity. While Bitcoin has largely thrived in inflationary environments, the stagflation scenario presents a new challenge.

Kobeissi’s analysis suggests that stagflation, with its mix of rising prices and economic stagnation, could create greater volatility for Bitcoin. The impact could be amplified by Bitcoin’s existing connection to traditional financial markets, which have often reacted negatively to economic instability. As the macroeconomic landscape shifts from a potential U.S. recession (a key talking point in 2024) to stagflation in 2025, Bitcoin’s performance could be tested in new ways.

According to a survey by Bank of America, 55% of high-net-worth investors expect stagflation to be a defining theme of 2025. This data underscores the growing consensus among financial professionals that this is the macroeconomic scenario most likely to shape the year ahead.

Bitcoin’s Bull Market Faces a Critical Test

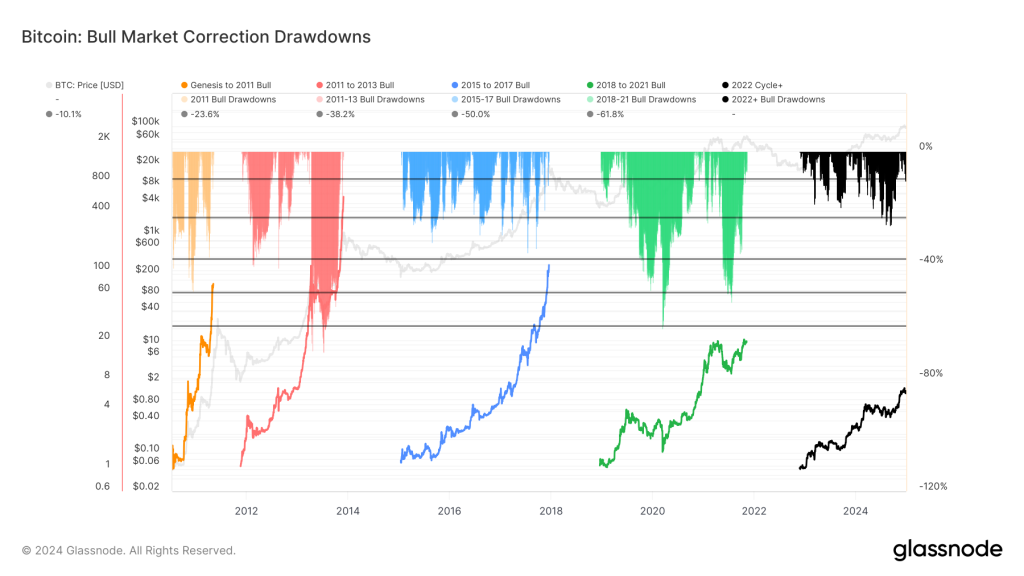

As Bitcoin enters a crucial phase in its bull market, its recent 15% correction at the end of December highlights the challenges ahead. While this drawdown is relatively mild when compared to the severity of past bull market pullbacks, the market remains uncertain. In fact, some analysts are questioning whether the market has yet found a definitive bottom.

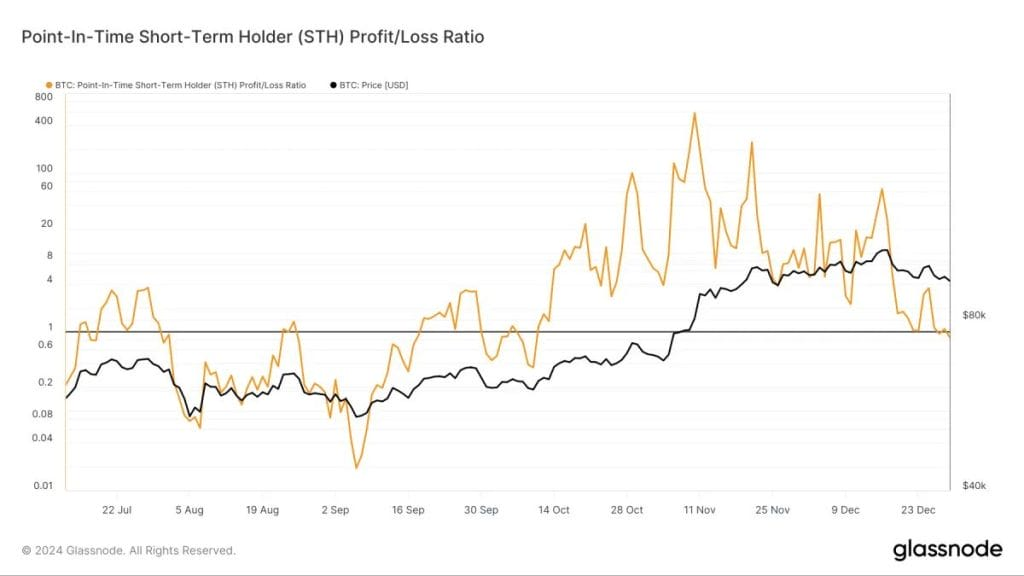

Glassnode data points to short-term holders (STHs) as a key indicator to determine when the market could bounce. The Market Value to Realized Value (MVRV) metric—an analysis that compares short-term holders’ profits and losses—suggests that Bitcoin may be approaching a “break-even” point. This could indicate a potential bottom in the market, which would provide a foundation for a recovery.

Historically, the MVRV ratio has been a reliable predictor of local market bottoms during bull cycles and tops during bear cycles. The last time this metric indicated a break-even point was in early October 2023, when Bitcoin traded at around $60,000.

A More Resilient Bitcoin

Despite the uncertainty surrounding stagflation and its possible impact on Bitcoin, the cryptocurrency market is evolving. A recent Maxiport report suggests that Bitcoin has “matured” this cycle, becoming more resistant to volatility thanks to increased adoption and institutional support. Unlike past cycles—marked by steep 80% drawdowns—Bitcoin’s expanding base of dip-buyers and growing institutional involvement could make the asset more resilient in the face of macroeconomic headwinds.

This maturation could reduce the likelihood of the severe corrections that have historically plagued Bitcoin. As institutional investors continue to enter the market and a broader base of retail investors develops, the market may be better equipped to handle volatility and absorb price fluctuations.

Navigating 2025: Bitcoin’s Potential Amidst Uncertainty

As we head into 2025, Bitcoin faces its most critical test yet. The confluence of stagflation concerns, a volatile macroeconomic environment, and changing investor sentiment creates a challenging landscape for the cryptocurrency. However, Bitcoin’s growing institutional support, increasing adoption, and improved market dynamics could give it a fighting chance to navigate through the uncertainty.

While the path forward may not be smooth, Bitcoin’s resilience in the face of current challenges suggests that it may continue to evolve as a valuable asset. As the global economy grapples with the potential of stagflation, Bitcoin could emerge as a critical asset in navigating these turbulent waters. But only time will tell if it can maintain its bullish momentum as it heads into 2025.