Crypto NEWS

“Ripple’s New Stablecoin Just Launched – Is RLUSD the Next Big Thing for Cross-Border Payments?”

Ripple Launches US Dollar-Pegged Stablecoin, RLUSD: A Game Changer for Cross-Border Payments?

On December 17, Ripple made a significant move in the crypto space by launching its highly anticipated US dollar-pegged stablecoin, Ripple USD (RLUSD). The stablecoin is designed to be fully backed by US dollar reserves, offering a solution to the volatility issues that typically plague digital currencies. This could be a game-changer for the global payments ecosystem, especially in the realm of cross-border transactions.

The launch of RLUSD is a clear indication that Ripple is doubling down on its mission to revolutionize the financial industry. With approval from the New York Department of Financial Services (NYDFS), Ripple’s new stablecoin aims to provide instant, low-cost global payments, while ensuring price stability.

What is Ripple USD (RLUSD)?

Ripple’s RLUSD is a 1:1 USD-backed stablecoin, collateralized by US dollar deposits, short-term US government treasuries, and other cash equivalents. The idea is simple: by tying RLUSD to the US dollar, Ripple aims to minimize the price volatility that often hinders the mainstream adoption of cryptocurrencies. This makes RLUSD a potentially vital tool for cross-border payments, where currency fluctuations are a significant concern.

RLUSD will initially be available on Ripple’s XRP Ledger (XRPL) and the Ethereum mainnet, with plans to expand to other blockchains and decentralized finance (DeFi) protocols in the future. This strategic move could open up RLUSD to a broader range of use cases, making it a key player in the rapidly evolving world of digital finance.

Ripple’s Focus: Instant Cross-Border Payments

Ripple’s main goal with RLUSD is to facilitate real-time global payments. The stablecoin is designed to simplify the conversion between fiat currencies and digital assets, enabling instant payouts and offering easy on/off ramps for users. Ripple has already lined up a series of exchange partners, including Uphold, Bitstamp, Bitso, MoonPay, and CoinMENA, to help distribute RLUSD on a global scale.

By integrating RLUSD with Ripple’s existing XRP-powered network, the company aims to combine the best of both worlds: the price stability of a stablecoin and the speed and efficiency of the XRP Ledger.

Key Features and Transparency

RLUSD is built with the intent of minimizing volatility, which makes it an attractive option for institutions and businesses looking for price stability in a digital currency. Ripple has made transparency a core principle of RLUSD’s development. To that end, the company has committed to publishing monthly, third-party audited attestations of its reserve assets. This will help ensure trust and regulatory compliance, addressing some of the concerns that have historically plagued stablecoins.

Ripple has also formed an advisory board for RLUSD, including high-profile figures such as former FDIC Chairman Sheila Bair and Ripple co-founder Chris Larsen. This shows Ripple’s commitment to “responsible development” and regulatory compliance as it rolls out RLUSD.

B2C2 and Keyrock will help provide liquidity for RLUSD, ensuring that the stablecoin can maintain its peg to the US dollar.

XRP Surges Amid RLUSD Launch

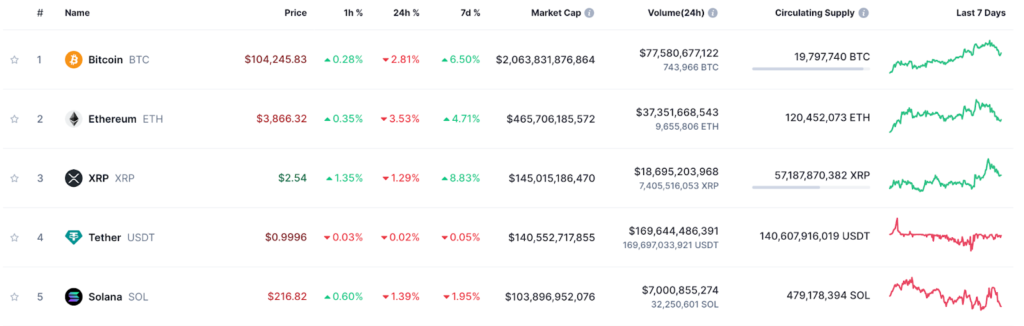

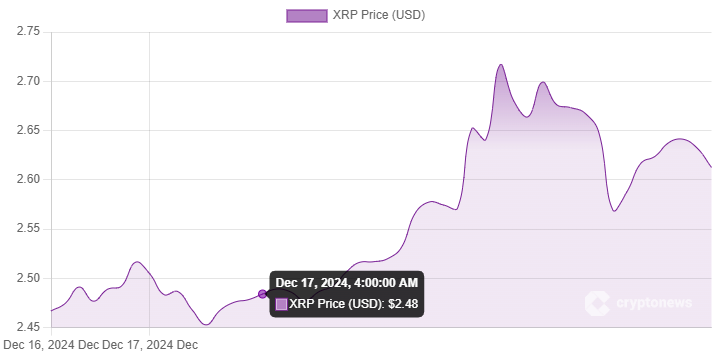

As Ripple launches RLUSD, XRP, the company’s native token, is enjoying a meteoric rise. XRP has surged more than 121% over the past 30 days, reaching a seven-year high of $2.89 on December 12. As of writing, XRP is trading at $2.60 per coin, with a market cap of over $144.8 billion—surpassing Tether (USDT) and Solana (SOL).

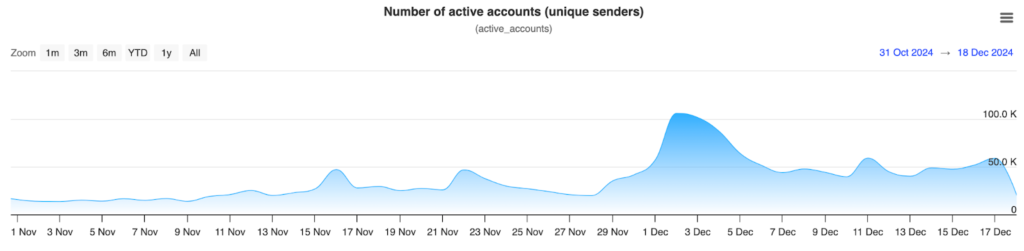

This surge has been driven by several factors, including Ripple’s new product launches, such as RLUSD and the tokenized money market fund on the XRP Ledger. Active accounts on the XRP network have also spiked, rising by 278% from November 1 to December 17.

XRP’s Bull Run: What’s Next?

XRP’s impressive performance has sparked speculation about its future. Some market analysts, including independent crypto trader Jacob Canfield, predict that XRP could double its all-time high. Canfield suggests that XRP could reach $6.60, citing the current bull run and the increasing institutional interest in the token.

One key factor driving XRP’s price is the anticipation of XRP exchange-traded funds (ETFs) in the US. Several asset management firms, such as WisdomTree and 21Shares, have filed applications with the SEC to launch spot XRP ETFs. If approved, these ETFs could provide institutional investors with easier access to XRP, further boosting liquidity and demand for the token.

However, Canfield also notes that XRP might face resistance in the $2.75-$3.00 range before it can break through to new highs. Investors will need to keep an eye on market trends and any potential regulatory developments to gauge XRP’s long-term trajectory.

The Battle for Stablecoin Dominance: RLUSD vs. USDC and USDT

RLUSD isn’t just another stablecoin; it’s positioning itself as a direct competitor to established players like USD Coin (USDC) and Tether (USDT). While USDC and USDT have dominated the stablecoin market, Ripple’s entry into this space with RLUSD could shake up the status quo.

There’s even speculation that Ripple could use its substantial XRP escrow holdings to back RLUSD. This could reduce the supply of XRP in circulation, potentially driving up its value. If this happens, it could not only increase confidence in RLUSD but also enhance the liquidity of the XRP Ledger.

Conclusion: A Bright Future for Ripple and RLUSD?

Ripple’s launch of RLUSD comes at a time when XRP is enjoying unprecedented growth, and the stablecoin could play a crucial role in the company’s broader vision for global payments. By offering a stable, US dollar-backed asset for cross-border transactions, RLUSD could become a go-to solution for businesses looking to send instant, low-cost payments internationally.

The battle for dominance in the stablecoin market is heating up, and Ripple is positioning itself as a serious contender. As XRP continues to gain traction and RLUSD expands its reach, Ripple’s vision of transforming global finance may be within reach.

The future looks bright for Ripple, but the journey is far from over. With more regulatory clarity, increasing institutional interest, and continued development, RLUSD and XRP could redefine the crypto and payments landscape.