Crypto NEWS

How to Monitor Crypto Exchange Inflows and Outflows for Smarter Trading

How to monitor inflows and outflows of crypto Exchanges

Understanding exchange dynamics is key to making informed trading decisions. Tools that allow for analyzing crypto flows provide a clearer picture of what is happening across the market.

Some tools that help traders monitor inflows and outflows are tracker systems on crypto platforms that include Glassnode, CryptoQuant and Nansen. These tools provide crypto exchange data analysis, which includes both onchain inflows and outflows.

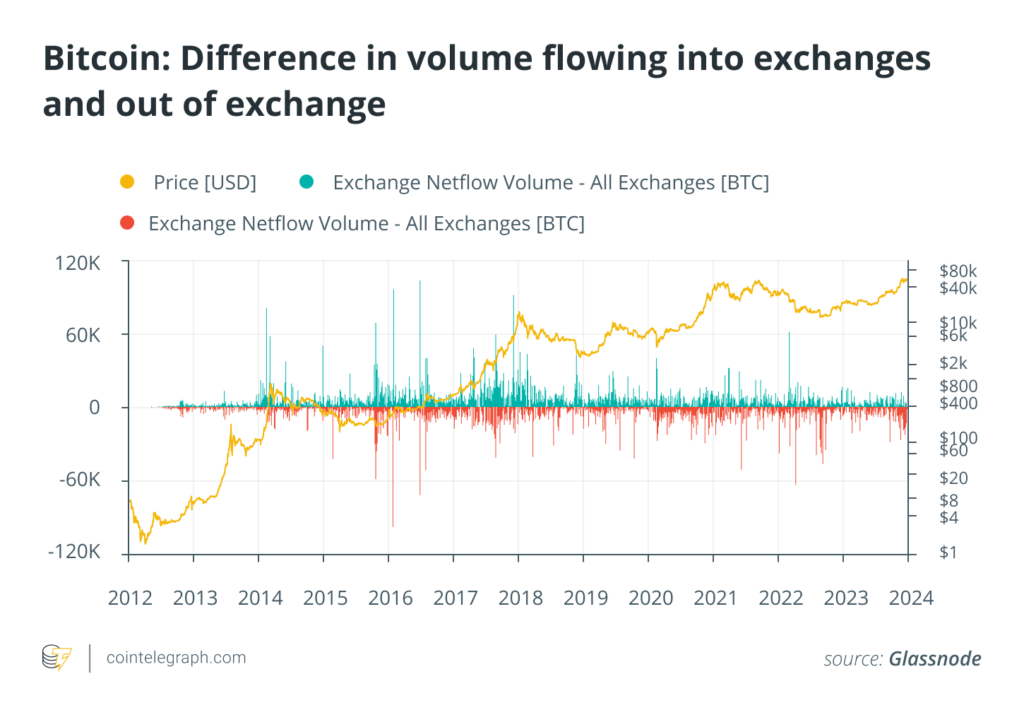

Tracking the movement of crypto in real time gives traders insight into potential trends, allowing them to respond quickly to market changes. For instance, the chart below illustrates Bitcoin’s price trajectory (yellow) alongside exchange netflows, both inflows (teal) and outflows (red) of BTC across all exchanges from 2012 to 2024. Netflows represent the balance of BTC entering and exiting exchanges. Positive values indicate more BTC flowing into exchanges, while negative values show more BTC leaving.

Surges in exchange inflows, marked by teal bars, often signal potential selling pressure as investors move BTC to exchanges for selling, which can precede price drops. Conversely, significant outflows (red bars) suggest accumulation, as BTC is withdrawn from exchanges, often signaling price increases. Traders use these netflows to adjust strategies, anticipating corrections with high inflows and accumulation phases with high outflows.

With tracking tools, traders can watch these flows in real time and get a better handle on overall market trends. This helps them stay ahead of price changes and make quick moves in a fast-paced market.

How inflows and outflows inform crypto trading Strategies

Tracking exchange netflows helps traders assess market sentiment and potential price movements, offering insights for strategic decisions like buying, selling or hodling.

Here are some strategies based on exchange netflows:

- Sell on high inflows: If inflows surge, it may indicate impending selling pressure, suggesting it’s a good time to sell before a price drop.

- Buy on high outflows: When outflows increase, it suggests accumulation, signaling a potential rise in prices — ideal for buying or holding.

- Range trading: During periods of steady inflows and outflows, traders might use a range trading strategy, capitalizing on price oscillations while liquidity remains stable.

- Trend following: If outflows continue to rise steadily, traders may follow the uptrend, staying long on assets as it signals demand and potential price increases.

- Reversal strategy: High inflows followed by a drop suggest the market may be overbought, signaling a potential price correction. Traders could enter short positions or exit existing ones to capitalize on reversal.

- Liquidity hunt: Significant inflows combined with sharp price movements indicate institutional or large traders positioning for volatility. Traders can take advantage of these moves by following the liquidity flow for short-term profits.

While netflows provide valuable indicators, no strategy is foolproof — it’s essential to manage risk with stop-loss orders and position sizing, as market conditions can shift unpredictably, leading to false signals.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.