Crypto NEWS

Continuation Of impermanent loss

Tools and calculators for calculating impermanent loss

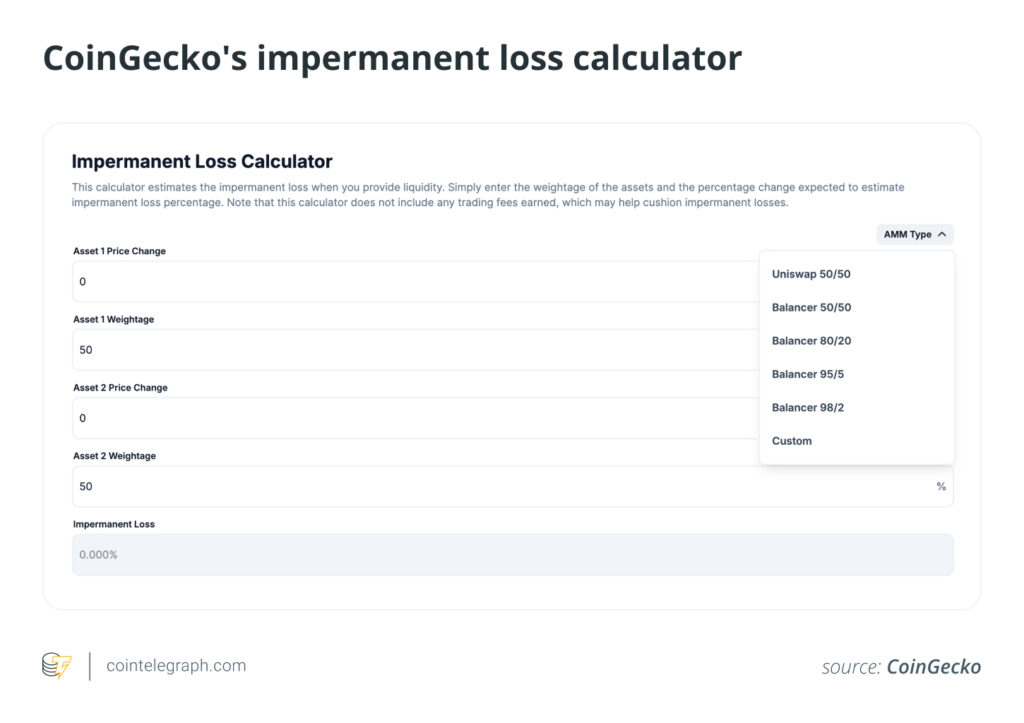

CoinGecko offers an easy-to-use impermanent loss calculator. By inputting the initial and current prices of your assets, you can quickly see how much impermanent loss you might experience. This tool is especially useful for beginners who want a straightforward way to assess their risks.

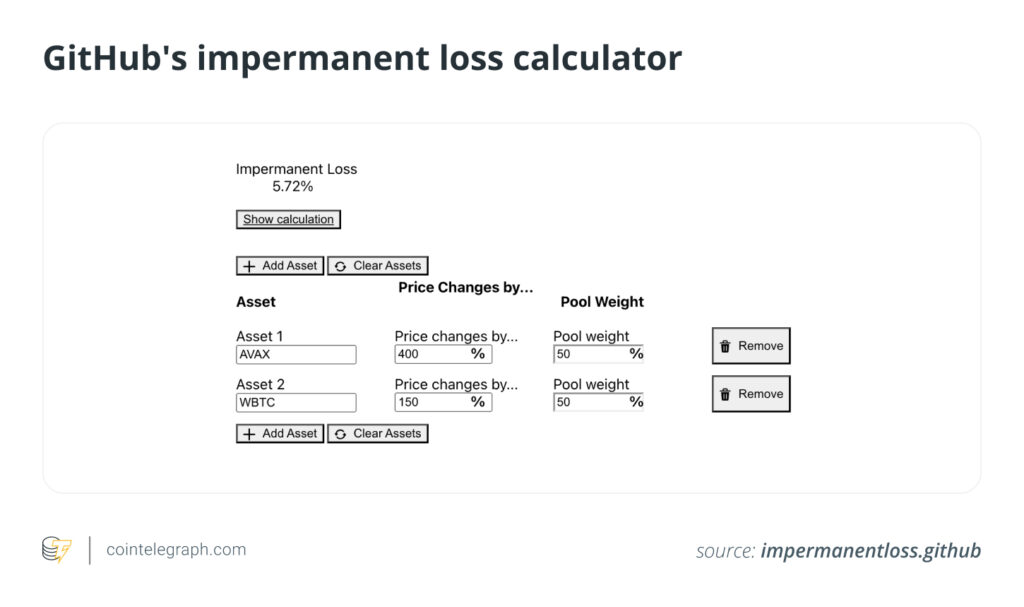

GitHub’s impermanent loss calculator

Another useful tool is GitHub’s impermanent loss calculator. This open-source tool provides a more detailed analysis, allowing you to input various parameters to understand how different factors impact impermanent loss. It’s a great resource for those who want a deeper dive into the calculations.

Using these calculators can help you make more informed decisions when participating in liquidity pools. Valuable insights into potential losses are key to managing your investments and reducing risks.

Managing and mitigating impermanent loss

Impermanent loss is a real concern for liquidity providers, but there are strategies to manage and reduce exposure.

Here are some practical tips.

- Use stablecoins or low-volatility asset pairs: Pairing stablecoins like DAI or USD Coin USDCtickers down$0.9992 can significantly reduce impermanent loss since their values remain relatively stable. Low-volatility asset pairs also minimize the risk of large price swings, helping to keep your investment more secure.

- Participate in liquidity pools with higher trading fees: Pools that charge higher trading fees can help offset impermanent loss. The fees collected from trades in the pool can compensate for the potential loss, making your overall returns more favorable. Look for pools that have a high volume of trades and higher fee structures.

- Diversify investments across multiple pools: Spreading your investments across various pools can help mitigate risk. By diversifying, you’re less exposed to the price fluctuations of a single pair. This strategy balances out potential losses in one pool with gains in another, leading to more stable returns.

- Utilize impermanent loss protection features: Some DeFi platforms offer features specifically designed to protect against impermanent loss. These platforms may provide insurance or compensation mechanisms that cover a portion of the loss. Taking advantage of these protections can safeguard your investments and give you peace of mind.

By applying these strategies, you can better manage and reduce your exposure to impermanent loss, making your liquidity provision more profitable and less risky.

Risks and rewards of providing Liquidity impermanent loss is the most talked-about risk in liquidity provision. Naturally, the greater the price divergence, the more significant the impermanent loss.

However, it’s not the only risk of providing liquidity.

DeFi platforms operate on smart contracts, which are not infallible. Bugs, vulnerabilities or exploits in the smart contracts can lead to significant financial losses. Even with audits, the risk of unforeseen issues remains.

Moreover, the regulatory environment for DeFi is still evolving. Changes in regulations can impact the functioning of DeFi platforms and the legality of certain activities, potentially leading to asset freezes or other legal complications.

Also, in times of extreme market stress, liquidity can dry up, making it difficult to withdraw your funds quickly without significant slippage. This can trap investors in positions that are rapidly losing value.

So, what makes it worthwhile?

Trading fees, mainly. Liquidity providers earn a portion of the trading fees generated by the pool. High-volume pools can generate substantial fee income, providing a steady and potentially lucrative revenue stream.

Many DeFi platforms also offer incentives in the form of native platform tokens. These rewards can significantly boost the overall return on investment, especially if the token appreciates in value.

Did you know? In high-volume liquidity pools, it’s not uncommon for liquidity providers to earn annual percentage yields (APYs) of over 20% or even higher, depending on the platform and the specific pool; however, these rewards need to be weighed against the potential risks, such as impermanent loss and smart contract vulnerabilities.

Governance tokens are also frequently issued to liquidity providers, giving them a voice in protocol decisions. This participation can be rewarding as it allows you to influence the direction of the platform and potentially benefit from its growth.

Moreover, by participating in liquidity pools, you may also gain access to yield farming opportunities. Yield farming can provide additional returns through incentives provided by DeFi protocols to attract liquidity.

For these reasons and more, many find that the risk of impermanent loss is worth the reward, much like those who sow their seeds in flood-prone fields.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.