Crypto NEWS

Ethereum’s Price Surge: What’s Driving ETH to New Heights?

Why is Ethereum (ETH) price up today?

Ether price hit a monthly high at $3,450 after the spot Ether ETFs saw a record $295 million inflow, and ETH’s open interest reached a new all-time high of $17.98 billion.

Ethereum’s native token, Ether ETHtickers down$3,250.75, reached a new monthly high of $3,450 on Nov. 12 after rallying 6%. The crypto asset is up roughly 30% for the month, showcasing its second-best monthly return since February 2024.

Ether’s price has also completed a bullish engulfing pattern over the previous three months, further solidifying a shift in ETH’s long-term market structure.

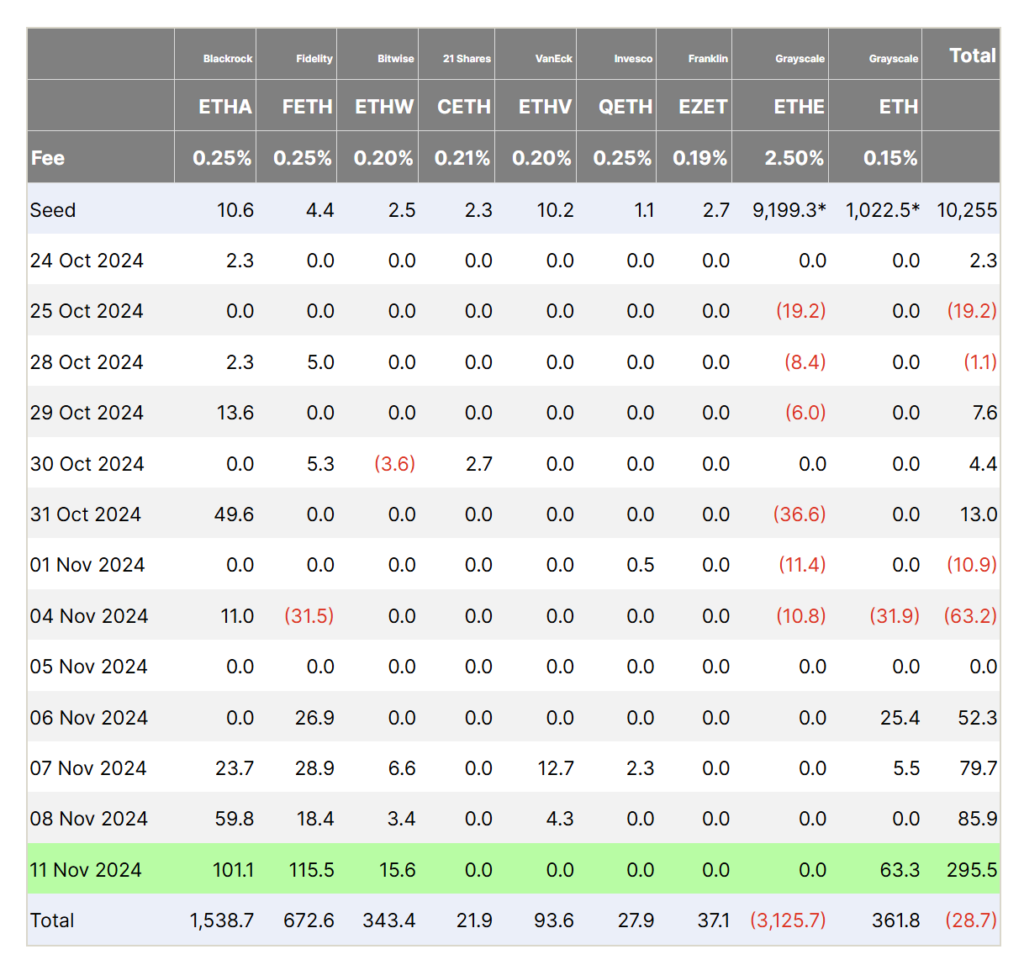

Ethereum ETFs register record $295 million inflow

US spot Ether ETFs witnessed record inflows of nearly $295 million on Nov. 11, with Fidelity’s Ethereum fund leading with $115.5 million. BlackRock and Grayscale also experienced significant inflows.

Cointelegraph reported that multiple analysts believed that Ethereum is gaining institutional investors’ attention, following a period of lagging behind Bitcoin BTCtickers down$86,729 and SolanaSOLtickers down$210.20 Rachael Lucas, a crypto analyst, indicated that Ether will continue to perform well, particularly if a pro-crypto administration promotes blockchain adoption

The latest Ether ETF inflows followed the development of the Michigan State Retirement System’s investment in Ethereum ETFs.

The fund disclosed ownership of 460,000 shares in the Grayscale Ethereum Fund (ETHE), estimated to be worth $10 million. It also held an equivalent of 460,000 shares in Grayscale’s Ethereum Mini Trust, which is valued at about $1.1 million.

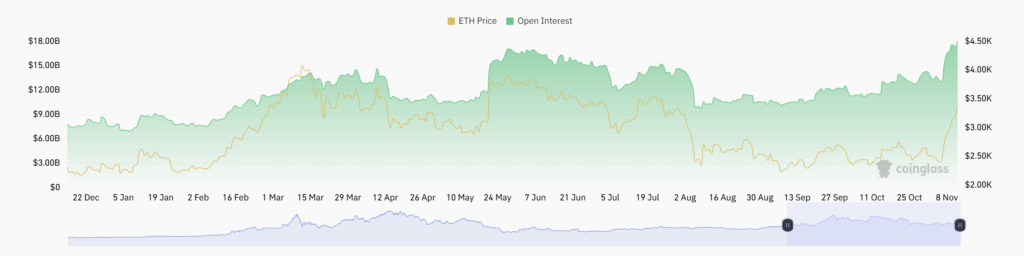

Ethereum open interest reaches new all-time high

With ETH price making new highs ever since Donald Trump’s presidential victory, traders are also taking more interest in futures positions. Data from CoinGlass indicated that Ether futures open interest reached a new all-time high of $17.98 billion on Nov. 12, surpassing its previous high range of around $17 billion from May 2024.

The recent price action may be responsible for the rising demand for leveraged bets, possibly dictating Ether’s immediate market highs.

From a technical perspective, Ethereum is currently experiencing resistance from its immediate resistance level or the supply zone between $3,350 and $3,550.

Ether’s first area of interest lies between $3,000 and $3,050, where the price may retest a fair value gap with a combined confluence of the 200-day simple moving average.

A deeper correction would potentially see ETH drop between $2,900 and $2,750, where the altcoin’s previous resistance range, second fair value gap, and 200-day exponential moving average will support a bullish continuation.