Crypto NEWS

“Ethereum Price Rally: Why ETH Could Hit $4,000 and Beyond Before Year-End”

Ethereum Price Surges as Bulls Eye $4,000 and Beyond

Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, is experiencing a remarkable rebound, breaking through critical resistance levels and sparking discussions about a potential rally to new all-time highs. With its price climbing nearly 10% in the past week, traders and analysts alike are speculating on what’s next for Ethereum.

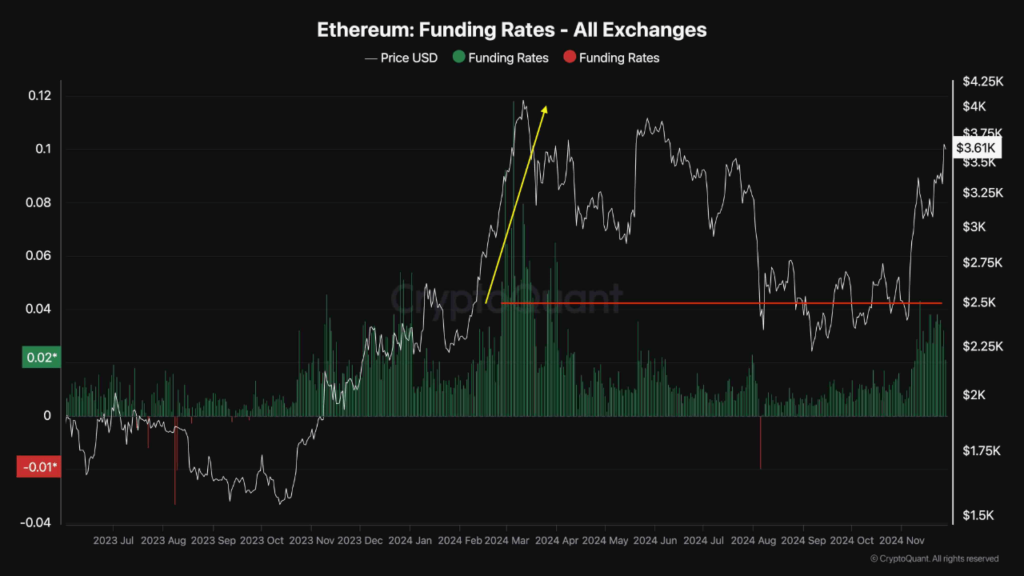

Renewed Interest in Ethereum Futures Signals Bullish Sentiment

A key driver behind Ethereum’s recent momentum is the renewed interest in its futures market. Market data reveals a surge in demand for long positions, a trend supported by funding rates—a crucial metric that gauges trader sentiment.

CryptoQuant analyst ShayanBTC recently highlighted this development, noting that Ethereum’s funding rates have steadily increased in recent weeks. This uptick reflects growing confidence in Ethereum’s upward trajectory but also serves as a cautionary indicator for potential market corrections.

According to Shayan, funding rates remain below the levels seen during Ethereum’s previous all-time high of $4,878, suggesting the market is not yet overheated. “This indicates more room for growth,” Shayan explained, though he warned that sharp increases in funding rates have historically preceded liquidation cascades.

Ethereum Breaks Through $3,500 Resistance

Ethereum’s bullish performance over the past two weeks has been nothing short of impressive, with the cryptocurrency posting double-digit gains of 15.6%. This upward momentum has allowed ETH to smash through the critical $3,500 resistance level, setting its sights on the next major milestone of $4,000.

Currently trading at $3,563, Ethereum has seen a 1.3% increase in the past 24 hours, with a slight pullback from its daily high of $3,682. Despite this minor retracement, Ethereum’s price is now just 26.78% below its all-time high of $4,878—a clear sign of its recovery in the broader crypto market.

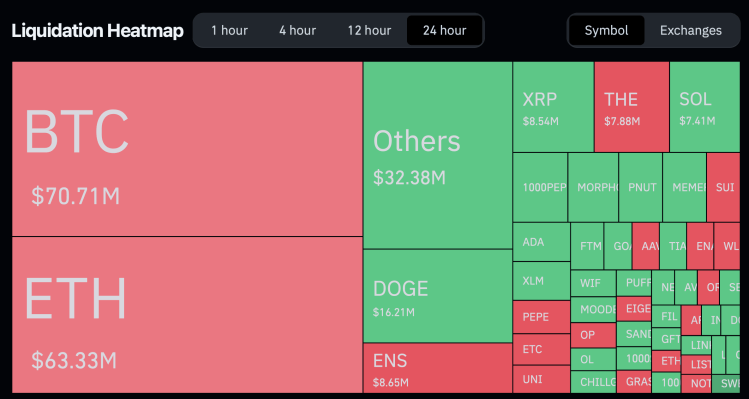

Liquidations Highlight Market Dynamics

While Ethereum’s price action has been largely bullish, the derivatives market has seen significant liquidations. Data from Coinglass reveals that in the past 24 hours alone, 98,389 traders were liquidated, with total liquidations amounting to $278.03 million.

Out of this, Ethereum accounted for $63.33 million in liquidations, including $40 million from short positions and $23.3 million from long positions. This dynamic underscores the heightened activity and volatility in the market as traders position themselves for Ethereum’s next moves.

Long-Term Targets: $6,000 and Beyond?

As Ethereum continues its upward march, prominent analysts are setting ambitious price targets. Ali, a well-known crypto analyst on X (formerly Twitter), reiterated his mid-term target of $6,000 for Ethereum, with a long-term goal of $10,000.

Such projections may seem bold, but they align with Ethereum’s increasing adoption, growing network activity, and bullish sentiment among institutional and retail investors.

Ethereum’s current rally reflects a blend of technical strength, renewed futures interest, and market optimism. While risks of short-term corrections remain, the overall outlook for ETH suggests the potential for further growth as it eyes the $4,000 mark and beyond. Whether Ethereum reaches new highs will depend on how these dynamics evolve in the coming weeks.