Crypto NEWS

Ethereum ETFs Eclipse Bitcoin ETFs Amid ETH Rally

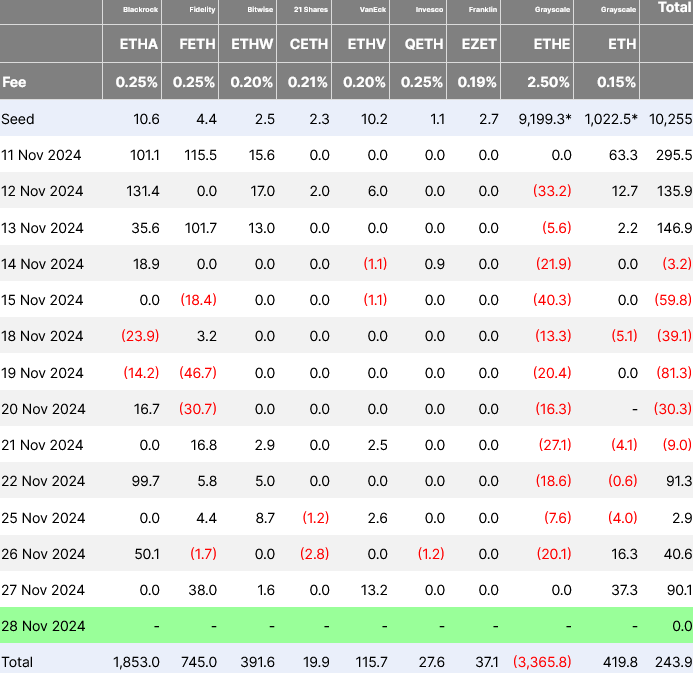

Ethereum exchange-traded funds (ETFs) are outpacing their Bitcoin counterparts in a dramatic fashion, signaling a shift in investor sentiment. Over the past four trading days (Nov. 22–27), spot Ether ETFs have seen net inflows of $224.9 million, overshadowing the $35.2 million inflows into spot Bitcoin ETFs during the same period, according to data from Farside Investors.

This surge comes amid a rally in Ethereum’s price and a series of events that have bolstered confidence in the blockchain’s decentralized finance (DeFi) ecosystem.

Ether’s Winning Streak in ETFs

Spot Ether ETFs are gaining momentum, thanks in part to an 8% rally in Ethereum’s price over the past week. ETH has risen to over $3,590, outperforming Bitcoin, which slipped 2% during the same period to $96,780. This brings the ETH-to-BTC price ratio back up to 0.037 BTC, highlighting Ethereum’s resurgence.

These inflows into Ether ETFs mark a potential turning point, with this week potentially being the first in which U.S. Ether funds outpace spot Bitcoin ETFs in net inflows.

Key Factors Driving Ethereum’s Rally

Tornado Cash Court Victory

One significant factor behind Ethereum’s recent price surge is the partial legal victory for Tornado Cash, an Ethereum-based crypto privacy mixer. The court ruling has reinforced Ethereum’s position as the dominant chain for DeFi, which continues to attract investor interest.

SEC Leadership Speculation

Reports suggesting that crypto advocate and former SEC Commissioner Paul Atkins could replace the current SEC Chair, Gary Gensler, have also contributed to Ethereum’s rally. A more crypto-friendly regulatory environment under Atkins could open the door to further innovation and investment in DeFi.

Markus Thielen, Founder of 10x Research, explained that “this underperformance [of Ethereum] was previously justified before the U.S. Presidential election, but with expectations of a more favorable regulatory environment, it now presents a potential opportunity.”

A Strong Month for Bitcoin ETFs

Despite Ethereum’s recent gains, November remains a record-breaking month for Bitcoin ETFs, which have amassed over $6.2 billion in net inflows. This includes a staggering $3.1 billion inflow in a single week.

However, Ethereum’s ETFs may be viewed as a “catch-up trade,” according to Thielen, as they lag behind Bitcoin and Solana in this bull cycle.

The DeFi Renaissance Under a Trump Presidency?

The potential for a decentralized finance (DeFi) renaissance under a Trump presidency has also fueled optimism. President-elect Donald Trump and his sons are reportedly involved in DeFi protocol World Liberty Financial, signaling their interest in fostering a robust DeFi ecosystem.

“This sends a strong signal of a potential DeFi renaissance under a Trump presidency,” Thielen noted.

Leveraged Spot Ether ETF Demand Surges

Investor appetite for leveraged spot Ether ETFs has soared by 160% since Trump’s election victory, according to a November 28 report from K33 Research. This rising demand underscores the market’s increasing focus on Ethereum as the DeFi space matures and regulatory conditions potentially improve.

Final Thoughts: Ethereum Steps Into the Spotlight

Ethereum’s recent rally and ETF dominance underscore its growing role in the cryptocurrency ecosystem. With legal victories, potential regulatory shifts, and surging demand for Ether ETFs, Ethereum appears poised for a breakout moment.

While Bitcoin maintains its stronghold as the largest cryptocurrency, Ethereum’s momentum in DeFi and ETF markets suggests a promising future—and perhaps a more competitive landscape ahead.