Crypto NEWS

Ether Poised to Breach $4,000 Before Trump’s Inauguration: Analyst Insights

The cryptocurrency market is buzzing with optimism as Ether (ETH) continues to outpace Bitcoin (BTC) in key performance metrics, signaling a potential rally above $4,000 before January 20, 2025. Analysts attribute this momentum to growing investor interest, robust futures data, and expectations of a more favorable regulatory landscape under the incoming U.S. administration.

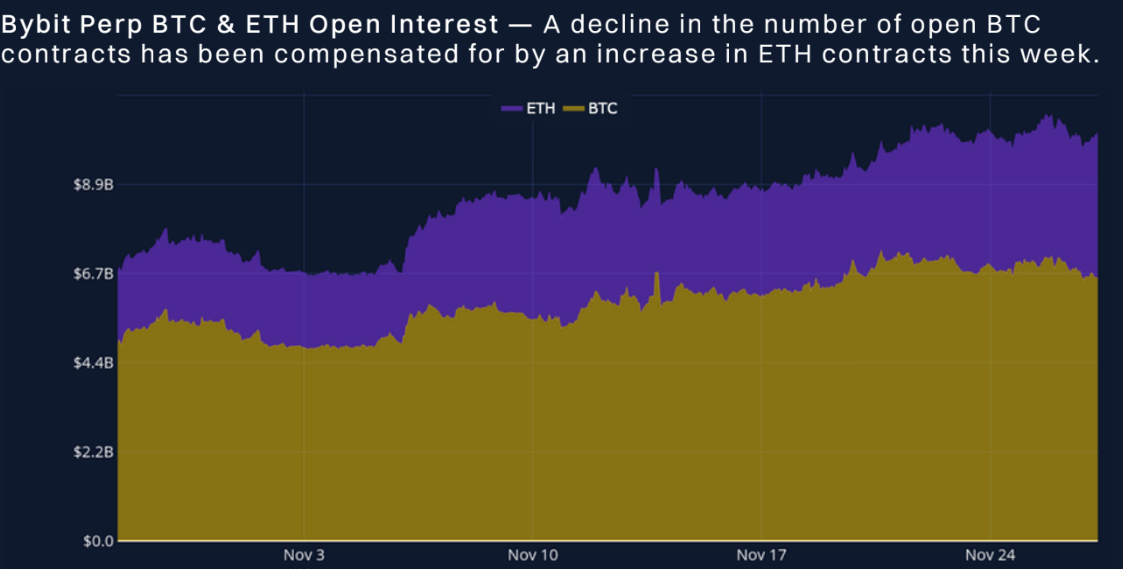

Ether Outpaces Bitcoin in Futures Yields and Open Interest

Ether has recently emerged as a standout performer in the cryptocurrency market, outshining Bitcoin in terms of futures yields and open interest. According to data from Bybit Analytics and Block Scholes, Ether’s open interest has surged to over $8.9 billion, surpassing Bitcoin’s $6.7 billion.

This shift suggests that Bitcoin’s declining open interest is less about panic-driven liquidations and more about calculated repositioning by investors. The resulting capital reallocation appears to favor Ether, which could further strengthen its price trajectory.

Investor Sentiment Strengthens Amid SEC Shakeup

Investor optimism around Ether has surged since November 21, following the announcement that Gary Gensler, Chair of the U.S. Securities and Exchange Commission (SEC), will step down on January 20. Gensler’s departure, coinciding with President-elect Donald Trump’s inauguration, has fueled speculation of more crypto-friendly regulatory policies ahead.

A Bybit spokesperson told Cointelegraph, “Bybit analysts see $4,000 on the horizon for ETH before Jan. 20,” highlighting the growing market confidence in Ether’s near-term potential.

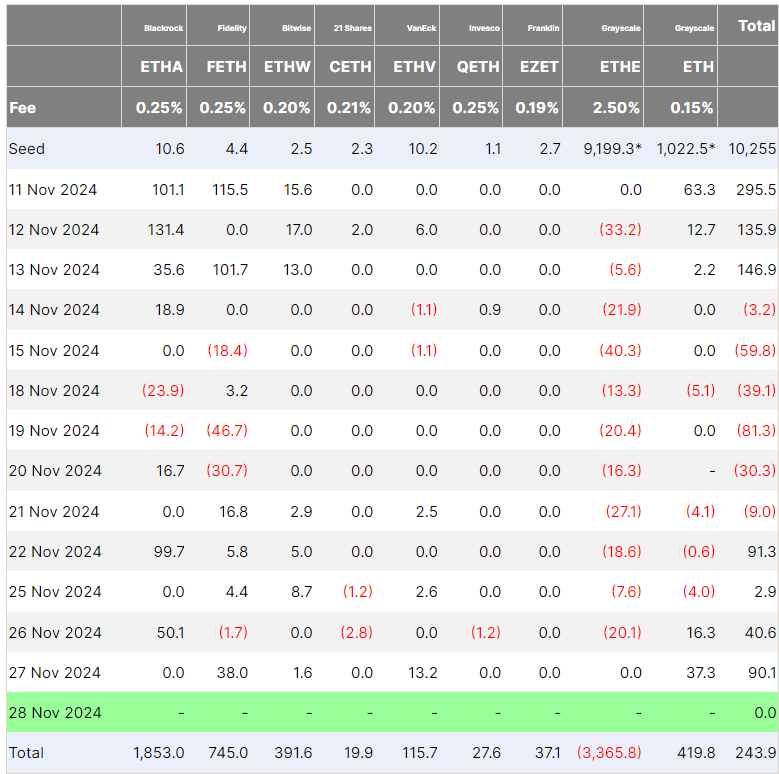

Futures Yields Signal Institutional Inflows

One of the most compelling signs of Ether’s bullish momentum lies in its futures market dynamics. A recent report noted that Ether’s futures contracts with just one week to expiration are trading nearly 25% above spot prices on an annualized basis.

This “strongly inverted implied-yield curve” is often associated with institutional interest, as investors capture the premium by selling futures contracts while buying the underlying spot asset. Such activity has previously driven Bitcoin’s strong spot ETF inflows and now seems to be shifting to Ether.

Indeed, Ether-focused exchange-traded funds (ETFs) are on a four-day winning streak, amassing over $90 million worth of Ether on November 27 alone, according to data from Farside Investors.

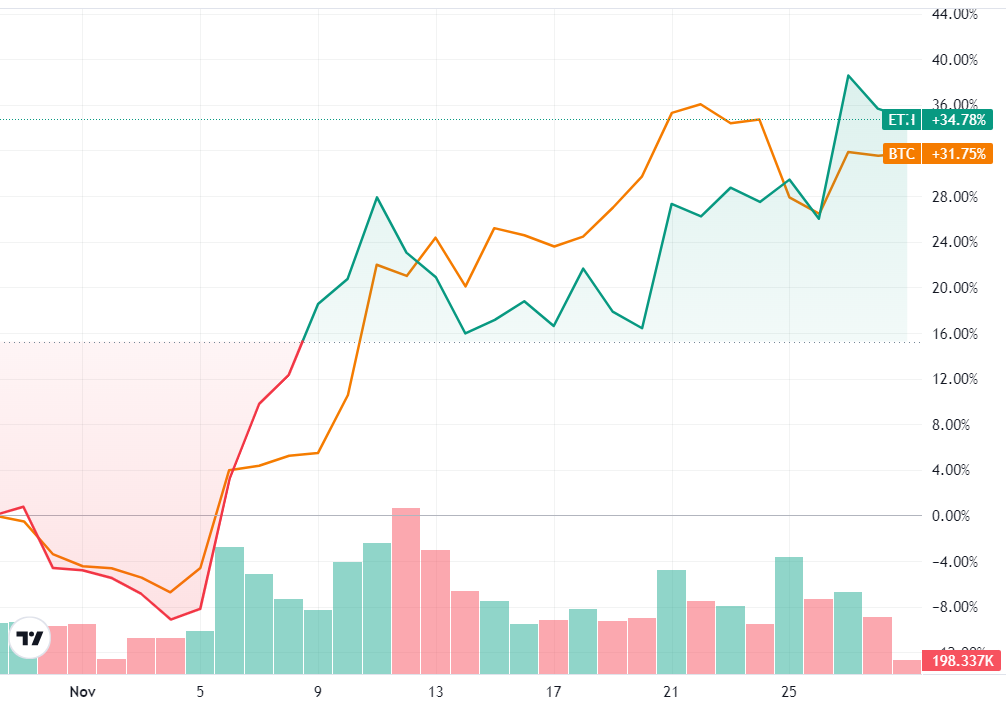

ETH’s Price Momentum Outpaces BTC

While Bitcoin has dominated the crypto narrative for much of the past year, Ether is now gaining ground. Over the past month, Ether’s price has climbed over 34%, slightly outpacing Bitcoin’s 31% rise.

This trend highlights a shift in investor focus, with Ether benefiting from its growing adoption, innovative use cases, and the increasing demand for leveraged ETH ETFs. Since Trump’s election victory, demand for these ETFs has soared by 160%, signaling heightened confidence in Ether’s future.

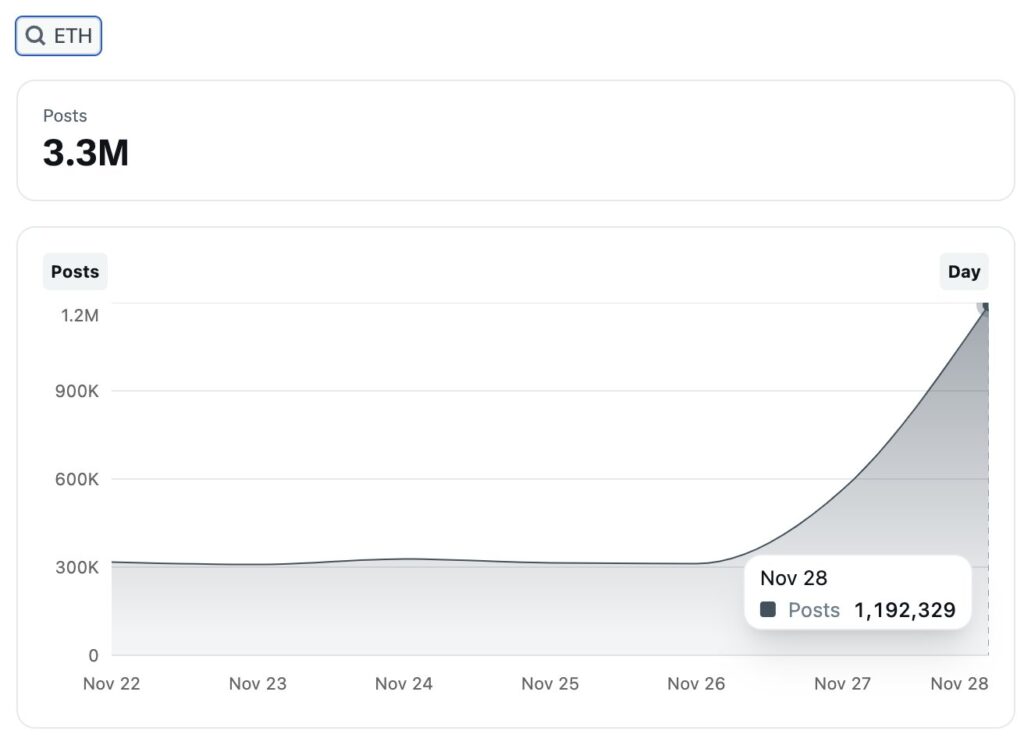

Social Metrics Add Fuel to the Rally

Social media activity around Ether has also reached new heights. According to CryptoQuant founder Ki Young Yu, posts related to Ether on X (formerly Twitter) have increased by over 282% in just three days, reaching 1.1 million on November 28.

Such widespread attention underscores the heightened interest in the world’s second-largest cryptocurrency, further bolstering its bullish outlook.

As institutional inflows continue to grow and investor sentiment remains robust, Ether appears well-positioned to breach the $4,000 mark in the weeks leading up to Trump’s inauguration. Whether this rally sustains into 2025 will depend on a mix of regulatory developments, macroeconomic factors, and continued momentum in the crypto markets.