Crypto NEWS

Bitcoin’s Slump and What Could Be Next: Binance’s Stablecoin Reserves Signal Potential RallyBy

By Robin Wigglesworth

Bitcoin’s recent price dip has left many market participants scratching their heads, but there are signs that this slump could be temporary. While the cryptocurrency’s inability to breach its all-time high of $99,800 has pushed its price below $95,000, indicators point to a potential rebound, driven by massive amounts of capital sitting on the sidelines.

BTC Faces a Price Slump

Monday morning saw Bitcoin take a significant hit, as its price dropped from just under $98,000 to below $95,000. The drop, which occurred after a quiet weekend, resulted in a painful price slump for many traders. The market’s woes were further exacerbated by liquidations, which soared to nearly $550 million in a single day, with long positions accounting for the majority of the sell-off.

The sharp downturn was a reminder that, despite Bitcoin’s impressive rally earlier in the year, the market remains highly volatile. But is this slump the end of the road, or merely a pause in a longer-term bull cycle?

Binance’s Record Stablecoin Reserves: A Sign of Hope

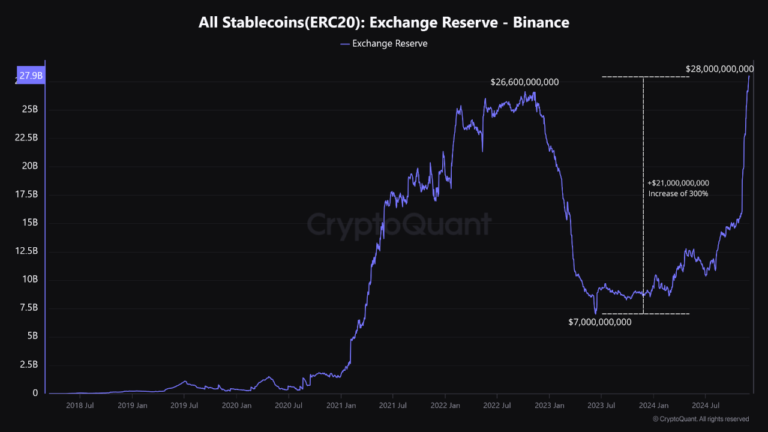

According to a recent report from CryptoQuant, there are signs that Bitcoin’s market cycle is far from over. The key indicator? A surge in stablecoin reserves on Binance, the world’s largest cryptocurrency exchange.

Binance’s ERC-20 stablecoin reserves recently hit an all-time high of over $28 billion. This unprecedented figure suggests that a substantial amount of capital is waiting on the sidelines for the right moment to enter the market. Given the exchange’s dominance in the crypto industry, this influx of capital could prove to be a major catalyst for a rally.

Binance’s role in the ecosystem is undeniable. The exchange serves as a liquidity hub, attracting both individual traders and institutional investors looking to trade or store stablecoins. With such a large sum of capital just waiting to be deployed, the potential for renewed market momentum is high.

Rising Reserves Signal Renewed Confidence

As the report notes, the increase in stablecoin reserves is indicative of rising market confidence, increased trading activity, and potentially higher staking volumes. While the market has retraced somewhat in recent days, this growing pool of stablecoins could help propel Bitcoin and other cryptocurrencies back into a rally phase.

Bitcoin’s Path Ahead: $120,000 on the Horizon?

With the potential for increased market activity, many are speculating about where Bitcoin could head next. Popular crypto YouTuber Crypto Rover has weighed in, suggesting a target of $120,000 for Bitcoin if the current bull run continues.

Crypto Rover pointed out a rare occurrence at the end of November—a monthly breakout for Bitcoin. Historically, these breakouts have often signaled the beginning of substantial price surges, with the price generally continuing to rise for months after such events.

If history repeats itself, Bitcoin could be on the cusp of another major rally, with its next target potentially reaching the six-figure mark.

The Bigger Picture

Bitcoin’s recent price dip is not necessarily a sign of a broader market downturn. While it’s clear that over-leveraged traders were hit hard by the recent liquidations, the growing reserves of stablecoins and bullish market sentiment suggest that a recovery could be just around the corner.

As Binance’s reserves hit new highs and market confidence grows, Bitcoin could very well resume its ascent—perhaps even surpassing its all-time high and reaching new milestones. For now, investors will be keeping a close eye on the market, waiting for the right moment to jump back in.

The stage may be set for Bitcoin’s next big move. Whether it’s $100,000 or $120,000, the road ahead looks promising for those watching the market closely.