Crypto NEWS

“Bitcoin Reserves Hit 5-Year Low—Is This the Start of a Major Price Surge?”

Bitcoin Exchange Reserves Hit 5-Year Low—What Does This Signal?

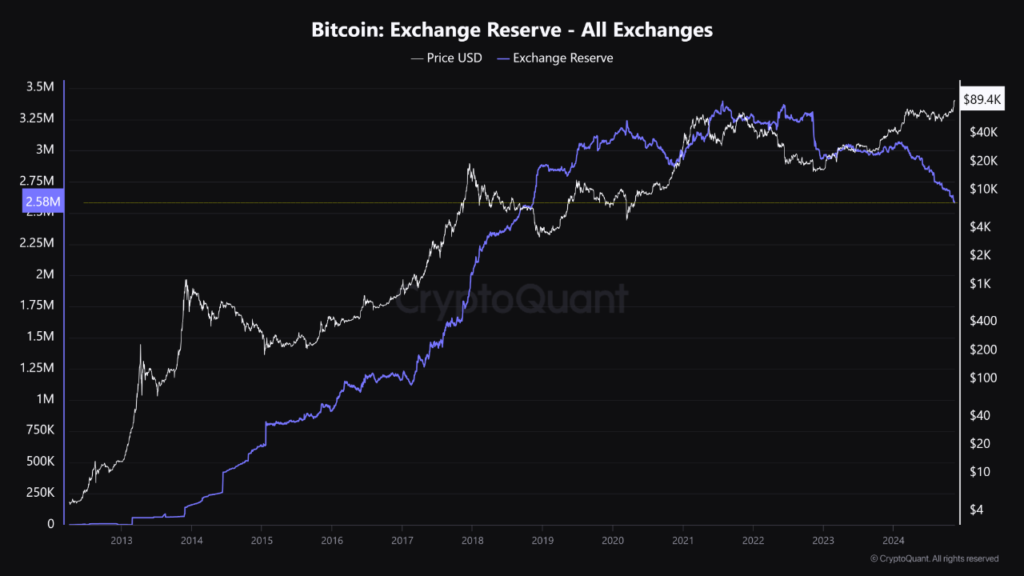

Bitcoin has recently seen a significant shift, as the amount of Bitcoin held on centralized exchanges has dropped to its lowest point since November 2018. This change, analyzed by CryptoQuant’s G a a h, highlights a notable shift in investor behavior, one that could signal a new phase for Bitcoin’s market dynamics. Here’s what it means for the future of Bitcoin.

A Decrease in Bitcoin Reserves on Exchanges

In 2024, Bitcoin reserves on exchanges have significantly diminished, which points to a growing trend of long-term holding. Investors appear to be moving their Bitcoin off exchanges and into private wallets. This change is not just a minor fluctuation—it’s indicative of a broader shift in the way Bitcoin is being used and viewed.

The move away from exchanges reduces the amount of Bitcoin available for immediate sale, which, in turn, creates buying pressure. In essence, as fewer coins are readily available on exchanges, the asset becomes more scarce, potentially increasing its value. This shift also reflects growing confidence in Bitcoin, as more investors treat it as a store of value, particularly amidst economic uncertainty and inflation.

G a a h highlights that this behavior is indicative of long-term thinking, with investors pulling their Bitcoin from exchanges to avoid the risk of sudden sell-offs. While this behavior may lead to a more stable price in the short term, it could also create heightened volatility. If demand continues to rise or remains consistent, the reduced supply of Bitcoin on exchanges could result in significant price swings.

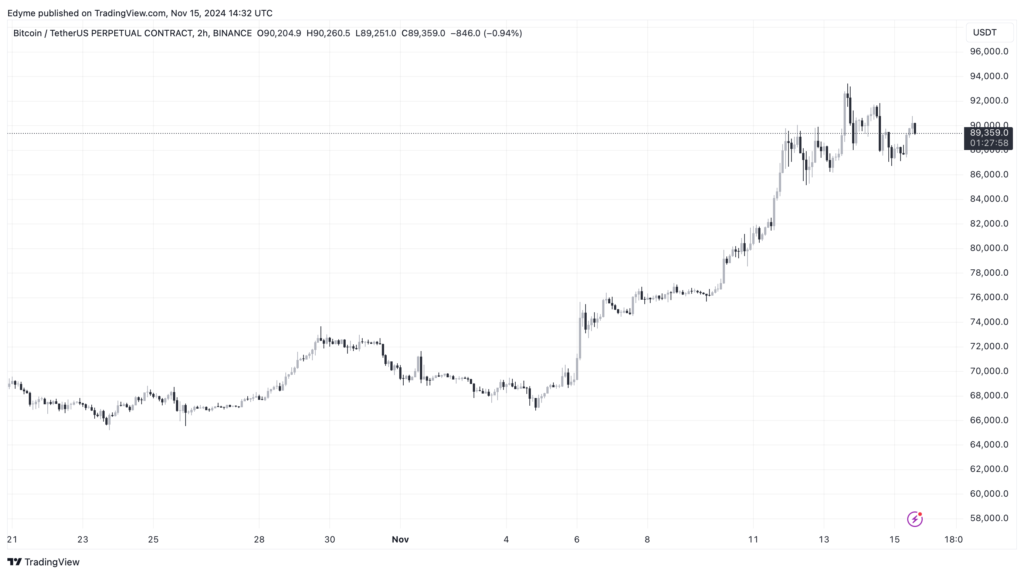

Bitcoin’s Upward Momentum Faces a Slowdown

Despite these positive signals in the long-term view, Bitcoin’s short-term price performance has cooled off. Following a record-breaking high of $93,477 on November 13, the cryptocurrency has faced a noticeable correction. As of now, Bitcoin is trading below $90,000 at $89,779—down by 4% from its peak. This recent price decline has caused a drop of around $49 billion in its market cap.

The market cap of Bitcoin now sits at $1.775 trillion, a decrease of nearly 5% from the $1.835 trillion valuation seen earlier this week. Trading volume has also seen a sharp decline, from over $100 billion to under $85 billion. This decrease in both market cap and trading volume points to a possible cooling of the market after a period of intense gains.

The Impact of Liquidations on the Market

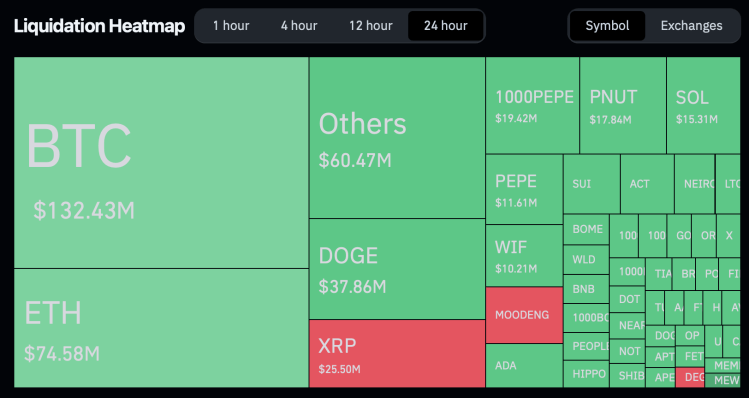

Bitcoin’s recent price dip has also caused significant liquidation events. In just the past 24 hours, approximately 170,215 traders were liquidated, with total crypto market liquidations reaching $510.13 million. Bitcoin accounted for $132.43 million of this total, with the majority of liquidations coming from long positions—investors who had bet on the continuation of Bitcoin’s bullish momentum.

What Does This All Mean for Bitcoin?

The diminishing reserves of Bitcoin on exchanges point to a long-term market shift. As more investors opt for holding their Bitcoin privately, the market could see less selling pressure in the future. This might result in a more resilient market, but also one that could experience greater volatility in the short term, especially if demand outpaces the available supply.

Bitcoin’s price correction over the past few days is a reminder that the market is unpredictable. While Bitcoin may have taken a breather after reaching new all-time highs, the trend toward long-term holding signals growing confidence in its future, even as short-term volatility persists.

For Bitcoin, this could be just the beginning of a new phase—less susceptible to short-term market fluctuations but possibly experiencing more volatile swings as demand continues to shape the market. Only time will tell if this shift towards long-term holding will pave the way for Bitcoin’s next big price surge.