Crypto NEWS

Bitcoin Reserve Won’t Solve U.S. Debt Crisis: Insights from a Think Tank Leader

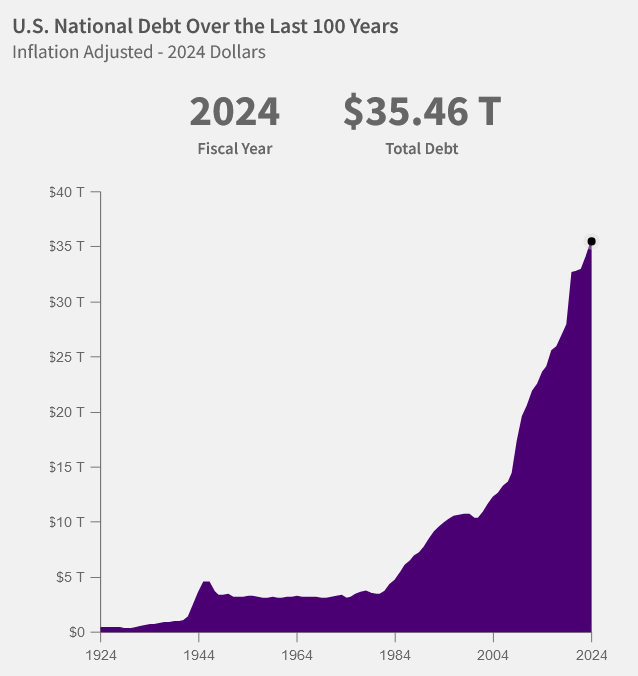

As the United States faces an ever-mounting federal debt now exceeding $35 trillion, a proposal to establish a strategic Bitcoin reserve has sparked debate. While proponents see Bitcoin as a revolutionary tool for economic stability, skeptics argue that it’s not a silver bullet. Avik Roy, president of the Foundation for Research on Equal Opportunity, recently weighed in, calling the idea “an overselling” of Bitcoin’s potential to address America’s financial woes.

Bitcoin Reserve: A Partial Solution, Not a Cure

Speaking at the North American Blockchain Summit 2024 in Dallas, Texas, Roy expressed doubts about the feasibility of using Bitcoin to eliminate the U.S. federal debt. The suggestion, championed by Senator Cynthia Lummis of Wyoming, hinges on the government buying and holding a strategic Bitcoin reserve as a hedge against fiscal instability.

“When Senator Lummis talks about a Bitcoin reserve eliminating the federal debt, that’s an overselling of what Bitcoin can do,” Roy remarked. While the concept of acquiring a substantial Bitcoin reserve could theoretically alleviate some fiscal pressures, it falls far short of addressing the $2 trillion annual federal deficit.

Bitcoin’s Role in Economic Stability

Could Bitcoin Back the U.S. Dollar?

Roy acknowledged that a Bitcoin reserve might help stabilize the bond market by partially backing the U.S. dollar. “We’ve got at least this ability to back enough of the U.S. dollar with Bitcoin that the bond markets can feel like the U.S. is not going broke,” he explained.

However, he warned of potential pitfalls, drawing parallels to how the U.S. depleted its gold reserves in the 1970s. This history raises concerns about the sustainability of a Bitcoin reserve as a long-term fiscal solution.

U.S. Debt Growth and the Path Forward

Debt Growth Outpaces Economic Solutions

The scale of the U.S. debt crisis is staggering. Since 1981, national debt has grown at a compounded annual rate of 5.3%, ballooning from $3.81 trillion to $35.46 trillion, according to U.S. Treasury data. Roy emphasized that while Bitcoin could provide a novel tool for fiscal management, meaningful progress requires significant budgetary reforms.

“You still have to actually do the budgetary reforms to get us out of this $2 trillion a year of federal deficits,” he asserted, underscoring that no single asset—Bitcoin included—can substitute for sound fiscal policy.

Avik Roy (left) speaking at the NAB Summit 2024 on Nov. 20. Source: Cointelegraph

The Bitcoin Act: Ambitions vs. Reality

In July, Senator Lummis introduced the Bitcoin Act, proposing that the U.S. government acquire 1 million BTC, representing roughly 5% of Bitcoin’s total supply, and hold it for at least two decades. She also called for converting a portion of the U.S. Treasury’s 8,000 tons of gold—valued at approximately $448 billion—into the proposed Bitcoin reserve.

Adding momentum to the conversation, President-Elect Donald Trump has pledged to establish a national Bitcoin stockpile as part of his economic strategy, signaling a shift toward integrating digital assets into federal policy.

Final Thoughts: Bitcoin as Part of the Puzzle

While a strategic Bitcoin reserve could provide certain economic benefits—such as boosting investor confidence and stabilizing the bond market—it is not a panacea for America’s fiscal challenges. As Roy highlighted, the key to resolving the debt crisis lies in comprehensive budgetary reform, not solely in speculative asset accumulation.

Bitcoin may play a role in the financial future of the United States, but as the debate continues, policymakers must balance ambition with realism to address the underlying structural issues driving the nation’s debt.