Crypto NEWS

“Bitcoin Hits $91K: Why This Rally Could Skyrocket to $100K!”

Bitcoin’s Rally Is Far From Over: Here’s Why BTC Could Soon Hit $100K

Bitcoin (BTC) has made headlines once again, with its latest rally pushing prices to nearly $94,000 before a short-term pullback. However, as BTC reclaims its footing above $91,000, new on-chain data points to an even more promising future. For investors and crypto enthusiasts, the question isn’t whether Bitcoin can hit $100,000—it’s when.

Bitcoin Pulls Back, But the Momentum Remains Strong

After a brief dip below $87,000, following an all-time high on Wednesday, Bitcoin’s price has largely recovered and continues to hover above $91,000. This short-term retreat could just be a blip on the radar, with more bullish signals indicating that the rally isn’t over.

Bitcoin Pulls Back, But the Momentum Remains Strong

After a brief dip below $87,000, following an all-time high on Wednesday, Bitcoin’s price has largely recovered and continues to hover above $91,000. This short-term retreat could just be a blip on the radar, with more bullish signals indicating that the rally isn’t over.

Why the Pullback Might Be Temporary

A brief pullback after hitting record highs is not unusual in the world of crypto. However, on-chain data—key indicators from the blockchain that track Bitcoin’s movements—suggests the fundamentals remain solid, and the market is poised for continued growth. The focus now is on the long-term outlook, which remains overwhelmingly positive for Bitcoin.

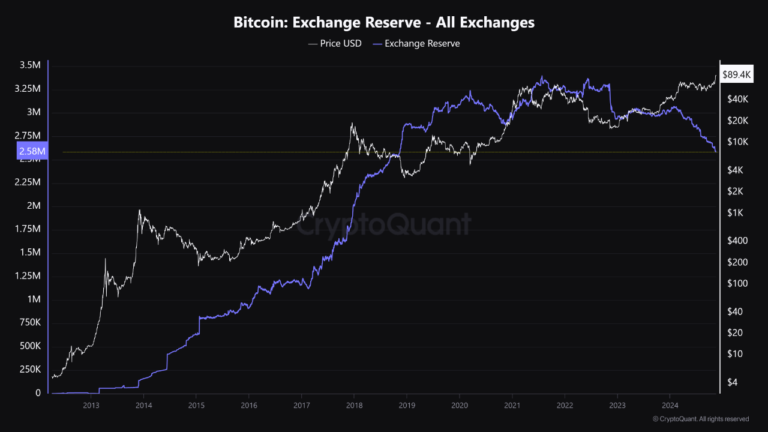

A Key Indicator: Bitcoin Reserves on Exchanges Drop

One of the primary indicators that suggests Bitcoin’s rally is not yet finished is the steady decline of Bitcoin reserves on exchanges. When Bitcoin is withdrawn from exchanges, it’s typically a sign that investors are either holding onto their assets for the long term or moving them to cold storage in preparation for higher prices.

Less Selling Pressure, More Buying Demand

According to data from CryptoQuant, Bitcoin reserves on exchanges have fallen to a six-year low of under 2.6 million BTC. This trend of withdrawal reduces the supply available for immediate sale, which creates buying pressure in a tighter supply environment. Essentially, fewer Bitcoins are readily available for sale, meaning any increase in demand could push prices even higher.

Bitcoin Reserves on Exchanges. CryptoQuant

> “This movement reduces the supply available for immediate sale, creating buying pressure in a tight supply environment. As a result, the market may see a trend towards Bitcoin’s appreciation, especially if demand remains stable or grows,” CryptoQuant analysts explained.

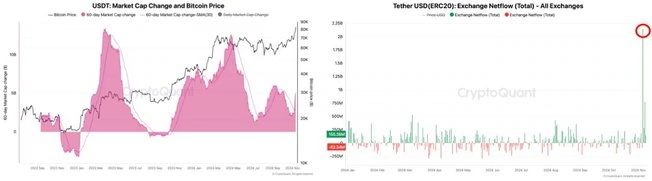

Stablecoins Are Growing, Boosting Market Liquidity

Another crucial factor fueling Bitcoin’s bullish outlook is the surge in stablecoin reserves on crypto exchanges. Stablecoins like USDT are increasingly being used by investors to enter the market, adding liquidity that makes it easier for larger players to allocate funds to Bitcoin and other cryptocurrencies.

Trump’s Victory Sparks a Surge in Stablecoins

Following Donald Trump’s win in the 2024 U.S. presidential elections, market liquidity surged, particularly in the form of stablecoins. CryptoQuant reports that more than $3 billion in USDT alone has entered crypto exchanges since the election, the highest influx in three years. This surge in stablecoins correlates with Bitcoin’s price rallies, suggesting that a growing number of investors are positioning themselves for further gains in the crypto space.

> “As more stablecoins flood the exchanges, there’s a higher potential for Bitcoin price rallies, as these funds are typically allocated to large-cap assets like BTC,” CryptoQuant noted.

What’s Next for Bitcoin? $100K in Sight?

Given the current on-chain trends, it seems increasingly likely that Bitcoin could continue its upward trajectory towards the $100,000 mark. The decline in reserves on exchanges and the rise in stablecoin liquidity are both signs that the crypto market is in a solid position for sustained growth.

The Market Outlook

Decreased Selling Pressure: With fewer Bitcoins available for immediate sale, any uptick in demand could lead to price surges.

Long-Term Holders Dominating: The growing dominance of long-term Bitcoin holders is contributing to a more stable, resilient market.

Rising Stablecoin Reserves: The increasing amount of stablecoins entering exchanges provides liquidity, fueling further investment in Bitcoin.

For Bitcoin, the path to $100,000 doesn’t seem like a question of if—it’s a question of when. With these bullish indicators continuing to trend upward, it’s safe to say that the best may yet be to come for the world’s leading cryptocurrency.