Crypto NEWS

“Bitcoin Price Decline: What’s Behind the Drop and What’s Next for the Market?”

Bitcoin Price Decline: What’s Behind the Dip and What’s Next?

Bitcoin has been drawing significant attention as it experiences a pullback after a remarkable surge. The world’s leading cryptocurrency has shed 7.6% from its all-time high (ATH) of $99,645 reached last week, with the price now hovering around $92,476—a 4.6% drop in just the past 24 hours. As the crypto market faces a correction, questions are emerging: is this a temporary dip or the beginning of a deeper downturn?

What’s Driving Bitcoin’s Current Decline?

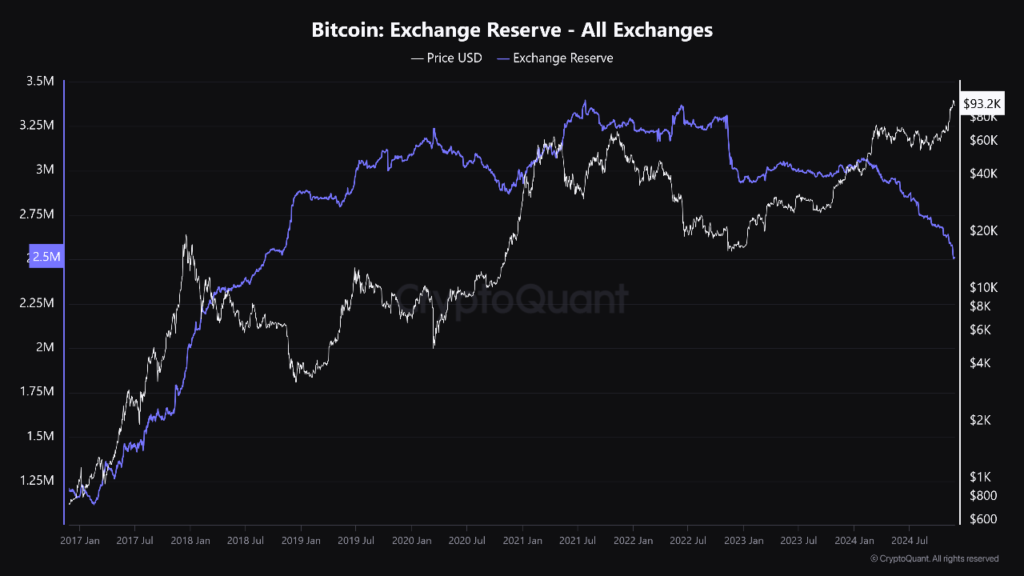

The ongoing price correction has many wondering whether Bitcoin is on the verge of another major surge or if this is the start of a more sustained downtrend. According to CryptoQuant analyst BaroVirtual, the decline in Bitcoin’s price may not be as concerning as it seems, particularly when viewed in the context of exchange reserves.

Exchange Reserves Decline Signals Potential Bullish Trends

BaroVirtual has pointed out a crucial trend: Bitcoin reserves across major exchanges have been steadily declining. This, the analyst suggests, is a typical sign of a “bull run” in progress. Drawing parallels to the March to November 2020 period, when a similar reserve decline occurred, BaroVirtual believes the current pattern suggests that a fresh wave of buying could be on the horizon.

In 2020, as exchange reserves dwindled, Bitcoin saw massive inflows in December, fueling the price surge that followed. The same pattern seems to be unfolding now, with many market participants who missed out on earlier accumulation opportunities likely preparing to enter the market before the next price surge.

The Last Correction Before the Next Surge?

BaroVirtual suggests that the current price dip might be the last correction before Bitcoin experiences another upward surge. The dwindling reserves imply that investors who didn’t accumulate Bitcoin during previous lows might now be entering the market, anticipating the next bullish phase.

Retail Traders Are Largely Absent from the Rally

Despite the growing institutional and high-net-worth investor participation, retail traders are still largely absent from the ongoing rally. This lack of retail involvement is noteworthy, as these traders have historically played a significant role in pushing Bitcoin’s price to new heights during rallies.

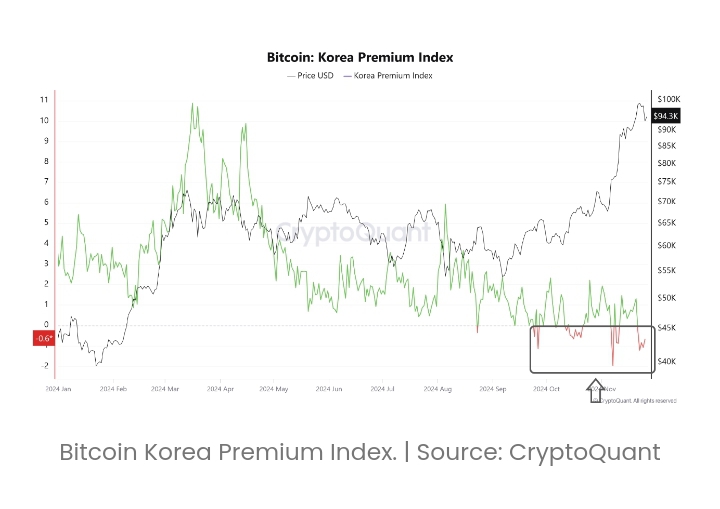

The Korea Premium Index: A Key Indicator

Woominkyu, another CryptoQuant analyst, has highlighted the Korea Premium Index as a crucial metric for understanding retail engagement. The index remains below -0.5, indicating limited retail activity. Historically, spikes in this index have preceded Bitcoin price peaks, suggesting that retail traders may be waiting on the sidelines for a clearer buying opportunity.

If and when retail traders start to engage more heavily in the market, their participation could provide the buying pressure needed to drive Bitcoin’s price higher. Until then, the market remains dominated by institutional investors, with retail traders yet to fully enter the fray.

A Broader Crypto Market Bloodbath

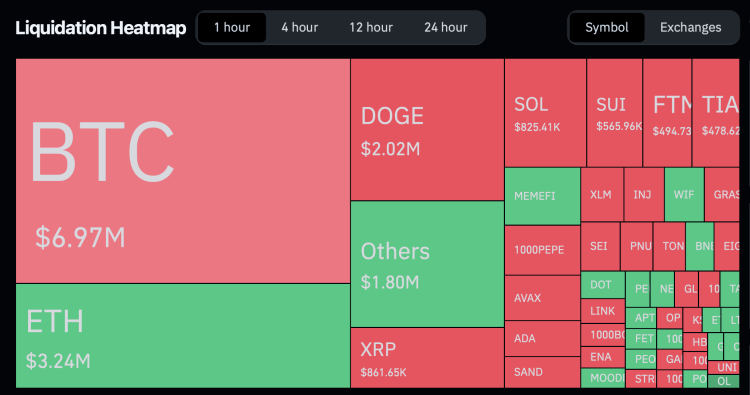

It’s not just Bitcoin feeling the heat. The broader crypto market is experiencing a significant downturn, with the global crypto market cap dropping nearly 6% in the past day, now sitting at $3.34 trillion. In the past 24 hours, nearly 206,491 traders were liquidated, resulting in a total liquidation amount of about $624.99 million. This reflects the ongoing volatility and risk within the market, which is experiencing significant price fluctuations.

Conclusion: A Critical Moment for Bitcoin and Crypto Markets

Bitcoin’s price dip, while significant, could ultimately prove to be a temporary correction in a larger upward trend. The decline in exchange reserves suggests that more buyers are likely to enter the market soon, potentially sparking a new price surge. However, the absence of retail traders remains a critical factor, with their future participation having the potential to drive Bitcoin’s price even higher.

As the broader crypto market grapples with volatility and liquidations, all eyes will be on Bitcoin’s next moves. Will this correction lead to a new rally, or is it the start of a prolonged downturn? Time will tell, but for now, market participants seem to be biding their time, waiting for the next big move.