Crypto NEWS

Bitcoin Profit-Taking Relatively Muted Amid $93K Rally – Can BTC Climb Higher?

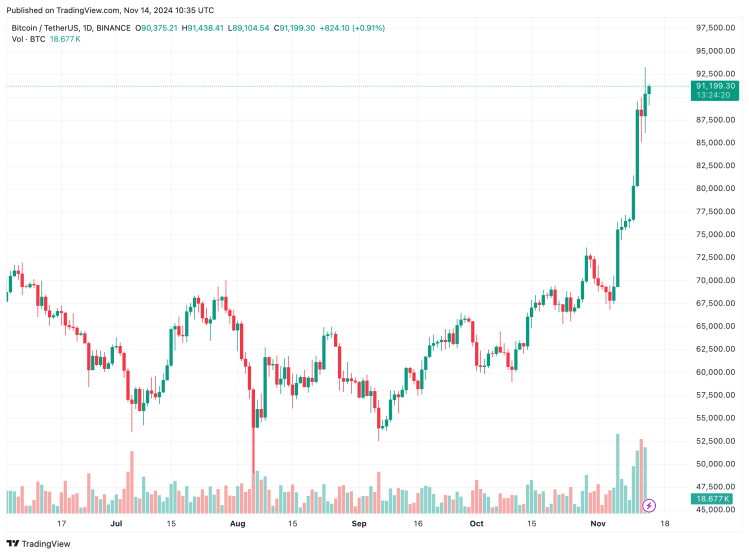

Bitcoin’s rally has reached new heights, and yet profit-taking remains surprisingly low. With Bitcoin (BTC) recently achieving an all-time high (ATH) of $93,477, many investors are now eyeing the much-anticipated $100,000 mark. This article will explore what’s driving this rally and assess whether Bitcoin has the momentum to surge even higher.

Low Profit-Taking in the Current BTC Cycle

Demand Drivers and Institutional Interest

According to a recent report from Glassnode, the surge in Bitcoin’s price is primarily driven by robust spot demand and heightened institutional interest. The recent election of Republican Donald Trump as U.S. President has also injected optimism into the digital assets industry, acting as a catalyst for Bitcoin’s upward trajectory.

Remarkably, despite Bitcoin’s price reaching a new ATH, profit-taking has remained relatively subdued. Glassnode’s report shows that over 95% of Bitcoin’s supply is currently in profit, yet this cycle’s profit realization has been modest. Historically, during past Bitcoin ATH cycles, monthly profit-taking has ranged between $30 and $50 billion. In contrast, the current cycle has seen approximately $20.4 billion in realized profit.

Signs of Potential for Further Growth

The muted profit-taking levels suggest there may be room for Bitcoin’s price to climb even higher before hitting significant resistance. Glassnode’s data provides an insightful look at the cost basis of new BTC investors by displaying upper and lower statistical bands in relation to BTC’s price.

Currently, Bitcoin’s spot price of $91,199 sits just below its upper statistical band at $94,900. Monitoring this price band movement could offer valuable insights into the pressure points where existing holders might be incentivized to sell. If Bitcoin continues to move within these bands without triggering significant sell-offs, it could indicate more upside potential in BTC’s price trajectory.

Need to Clear Excess Leverage Before $100,000 BTC

Balancing the Leverage Dynamics

While Bitcoin trades just below the $100,000 milestone, industry experts are sounding a note of caution. Excess leverage, particularly in the form of highly leveraged futures contracts, could create volatility, which might hinder Bitcoin’s immediate push toward the six-figure level.

Data from Coinglass shows that $718 million in crypto contracts were liquidated in the last 24 hours, impacting over 200,000 traders. Interestingly, these liquidations were almost evenly split between long and short positions (49.93% longs and 50.07% shorts), reflecting a balanced market where neither bulls nor bears currently hold a definitive trading advantage.

Expert Views on Bitcoin’s Future Price

Despite the cautious sentiment around leverage, many industry leaders remain bullish on Bitcoin’s longer-term prospects. For instance, in October, CleanSpark’s CEO expressed confidence that Bitcoin could reach $200,000 within the next 18 months. Similarly, Arthur Hayes, co-founder of BitMEX, recently forecasted that Bitcoin could reach $1 million under the Trump administration.

BTC Outlook: Where Do We Go from Here?

At press time, Bitcoin is trading at $91,199, marking a 3.9% increase in the last 24 hours. While it remains to be seen whether Bitcoin can sustain this momentum to cross $100,000, the relatively low levels of profit-taking and strong institutional demand suggest that Bitcoin’s rally may have further to go.

The question remains: Will Bitcoin break through the $100,000 threshold? Or will a flush of leverage and cautious sentiment among traders cool off its meteoric rise?