Crypto NEWS

“Why Toncoin’s Soaring Market Cap and Surging User Activity Could Make It the Hottest Altcoin of 2024!”

Toncoin (TON) has recently experienced significant shifts in its market landscape, largely influenced by changes in supply and increasing user engagement across its platform. A deep dive into Toncoin’s dynamics reveals a maturing network and a growing user base, which together are shaping its market positioning and future outlook.

Toncoin’s Supply Evolution and Liquidity Trends

According to CryptoQuant analyst Shiven Moodley, TON’s total supply has shown a steady upward trend, expanding from approximately 5.01 billion tokens to around 5.1 billion tokens. This increase highlights a moderate but consistent supply growth, suggesting ongoing network development and token distribution.

However, TON’s circulating supply has seen more volatility, particularly with a notable drop in early 2024. This reduction in circulating supply is primarily due to lockups and staking activities within the network, which reflect a shift towards greater liquidity control and user interest in long-term holding. Moodley notes that the circulating supply trends mirror a rise in TON’s market liquidity and an inclination among users toward staking commitments and longer-term retention.

Layer-One and Layer-Two Comparisons: TON’s Competitive Position

In his analysis, Moodley underscores the role of user engagement within TON’s ecosystem, particularly focusing on the Masterchain and Workchain components. Apps and games hosted on the Workchain, such as Hamster Kombat, DOGS, and Catizen, have been instrumental in driving trading activity within the network. These projects have created dynamic, interactive spaces that attract users and sustain engagement.

How TON Stands Among Altcoins

Moodley also places TON in a comparative context among prominent altcoins and blockchain networks. Over the past six months, TON transactions have exhibited a consistent pace, with periodic spikes primarily tied to airdrops for in-network games. This steadiness in transaction volume establishes TON as a resilient layer-one blockchain network that compares favorably with competitors like Arbitrum.

> “This growing user base would likely shift trader psychology toward holding over the medium to long term, thus reducing market liquidity within the TON ecosystem,” Moodley explains.

As more users participate in staking and other network activities, TON’s liquidity dynamics could be impacted by reduced market availability, which may support price stability and long-term growth potential.

Toncoin’s Recent Market Performance

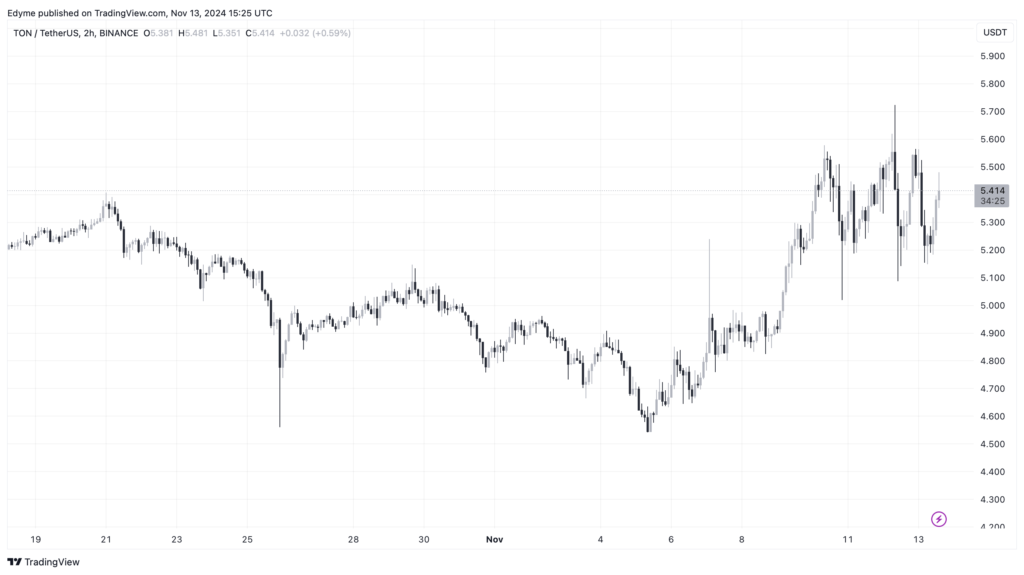

Amid a broader crypto market upswing, Toncoin has enjoyed substantial gains. Over the past week, TON’s market cap and price have both surged by more than 15%, positioning the altcoin among the top performers. Currently, its market cap exceeds $13.8 billion, with a price of $5.41, marking a 1.4% increase in the last 24 hours.

Trading Volume Trends

Interestingly, despite TON’s price and market cap gains, its daily trading volume appears to have cooled. After peaking above $1 million on November 12, it currently stands around $679 million, a potential indicator of evolving trader sentiment as holders become less inclined to sell.

The Outlook for Toncoin

Overall, the TON community remains optimistic about the altcoin’s future. Influential analyst CryptoBullet recently projected a price target of $12 to $15 for TON, citing the platform’s strong fundamentals and growing network activity.