Crypto NEWS

Understanding Crypto Exchange Outflows: What They Reveal About Market Sentiment

Inflows on crypto exchanges, Explained

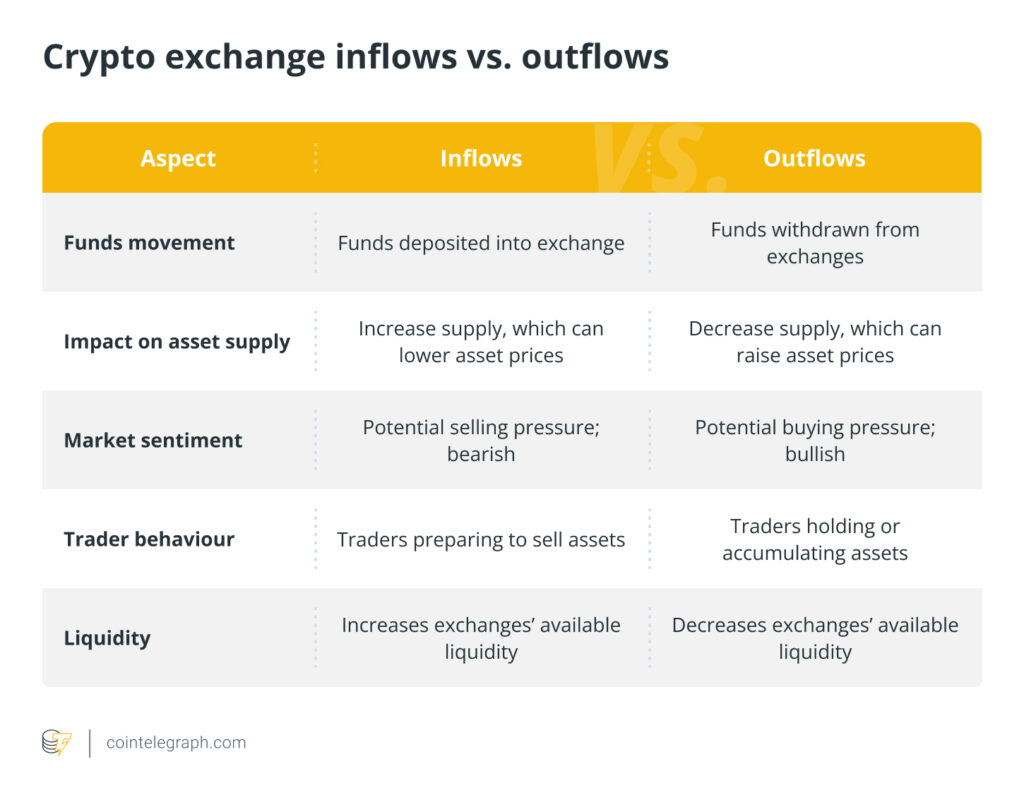

Understanding how inflows and outflows affect crypto prices is crucial for navigating market dynamics. Inflows, representing the influx of liquidity into exchanges, can positively impact prices. Conversely, outflows, indicating the withdrawal of funds, can exert downward pressure on prices.

Liquidity – the ease with which assets or goods can be bought or sold — is vital for traders, users and investors. When referring to inflows and outflows on exchanges, it involves tracking the movement of cryptocurrencies into and out of these trading platforms.

In the crypto world, traders, users and investors closely watch crypto exchange liquidity flows because these movements reveal changes in supply, demand and potential market direction. Therefore, understanding exchange liquidity is key to making informed decisions.

Tracking these metrics helps traders assess the demand and supply of a cryptocurrency. Inflows and outflows matter because they can give traders clues to whether the market might go up or down, based on where the assets are moving.

Between Oct. 26 and Nov. 2, cryptocurrency funds saw $2.2 billion in inflows, driven by the anticipation of US elections. This brought the total year-to-date inflows to a record $29.2 billion. Bitcoin products were the primary beneficiaries, seeing a large portion of the inflows. The market sentiment was influenced by the potential for a Republican victory, boosting investor confidence.

Types of inflows on crypto exchanges

When large amounts of cryptocurrency are deposited into an exchange, this is referred to as inflow. Crypto market inflow analysis often indicates that traders are preparing to sell.

This increase in supply often pushes prices down since more assets are available for trading, and demand remains relatively constant. In simple terms, when more people are selling than buying, the market reacts by lowering prices to even things out.

Large inflows can also happen due to broader market events, like negative news regarding crypto, new regulations or economic shifts. During uncertain times, traders often move their crypto onto exchanges to sell, which can lead to more volatility and falling prices as people lose confidence.

Big players like hedge funds also contribute to inflows. When they decide to liquidate a chunk of their holdings, the market can experience a domino effect, where others follow suit, pushing prices down even further.

In times of market corrections or expected price drops, traders often send their assets to exchanges to sell before prices fall even further. Monitoring these inflows helps traders spot potential sell-offs early and adjust their strategies to avoid losses.

It is important to point out that understanding outflows in crypto markets is just as relevant as understanding inflows.

Outflows on crypto exchanges, explained

When outflows are high, it usually shows that investors are moving their assets off exchanges, which often suggests they are holding them for the long term — a behavior that can indicate a potential price increase.

Looking at crypto exchange movement trends gives clues about how the market is behaving. Outflow metrics are valuable for understanding the movement of cryptocurrencies leaving exchanges. By studying these trends, traders can gain insights into shifts in market sentiment.

For example, a sudden spike in outflows — triggered by news of new regulations or a sharp price movement — often reveals how the market is reacting. These trends help traders make better, more informed decisions.

Types of outflows on crypto exchanges.

The impact of outflows on market liquidity can significantly shape crypto market trends and have various consequences. Some common types of crypto outflow are withdrawals to external wallets, transfers to DeFi platforms and conversions to fiat currencies.

Crypto outflows occur when users move assets from exchange wallets to personal wallets for long-term storage, security or to participate in decentralized finance (DeFi) activities like lending or yield farming. Withdrawals can also involve converting crypto to fiat currency.

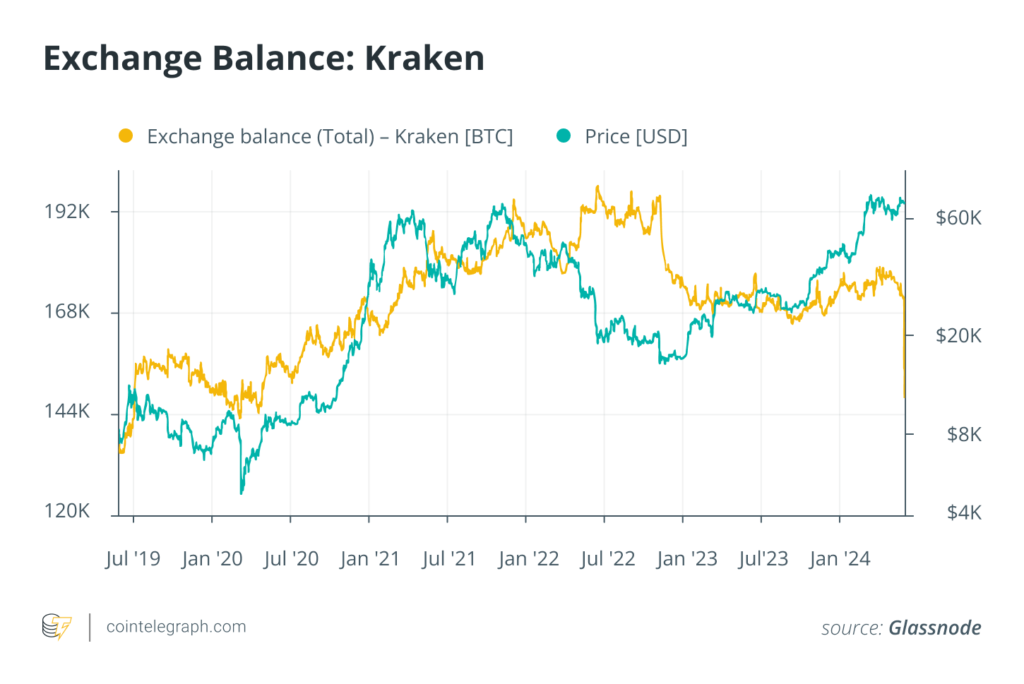

On May 30, 2024, Kraken saw its largest Bitcoin outflow, with about $1.6 billion worth (at that time) of Bitcoin (28,000 BTC) transferred out. This coincided with Bitcoin’s price surge above $69,500. The transfers occurred in five large transactions, suggesting either internal movement or possible large purchases. The outflows resulted in a significant drop in Kraken’s exchange balance to 148,000 BTC, the lowest since May 2020.

Here’s what crypto exchanges’ outflows reflect:

- Outflows and liquidity impact: Large outflows often lead to reduced liquidity on exchanges, meaning there may be fewer assets available to trade, potentially pushing prices upward.

- Market sentiment indicators: Moreover, exchange outflows and market impact can serve as indicators of whether investors expect long-term gains.

- Volatility increase: Reduced liquidity due to outflows can also increase price volatility. With fewer assets available, even small buy or sell orders can cause larger price swings, making the market more volatile in the short term.

- Investor confidence: In addition, substantial outflows often reflect investor confidence in the asset’s future price. When investors move their holdings off exchanges, it suggests they are less likely to sell in the near future, reducing immediate selling pressure.

- Accumulation and long-term supply reduction: During periods of accumulation, when investors are holding assets in anticipation of higher future returns, outflows help reduce the immediate supply of assets available on exchanges. Over time, this can lead to sustained price increases as the shrinking supply meets continued or growing demand.

Monitoring outflows provides insights into market sentiment, but it’s important to consider them alongside other factors such as trading volume, price trends and onchain data for a complete market analysis. Outflows alone don’t provide a full picture of market conditions.