Crypto NEWS

“Bitcoin Inches Closer to $100K: Will the Rally Soar or Collapse?”

Bitcoin Nears $100,000: A Historic Milestone or a Moment of Reckoning?

Bitcoin’s extraordinary rise has captivated the financial world, as the cryptocurrency touched a staggering $99,500 earlier today. The market buzzes with anticipation of Bitcoin’s breakthrough into six-figure territory, yet on-chain data hints at potential challenges ahead. Could this remarkable rally continue, or is a pullback looming?

Unstoppable Momentum: Bitcoin’s Relentless Surge

Since November 5, Bitcoin has climbed an astonishing 45%, smashing through resistance levels and reaching new all-time highs for four consecutive days. The surge has sparked bullish sentiment across the market, with traders eyeing the $100,000 milestone—a level widely regarded as both a psychological and technical landmark.

Despite the relentless upward momentum, demand has managed to absorb increasing selling pressure. Investors remain optimistic that Bitcoin will soon break into uncharted territory, fueled by continued institutional interest and robust retail participation.

Profit-Taking by Long-Term Holders: A Cause for Caution?

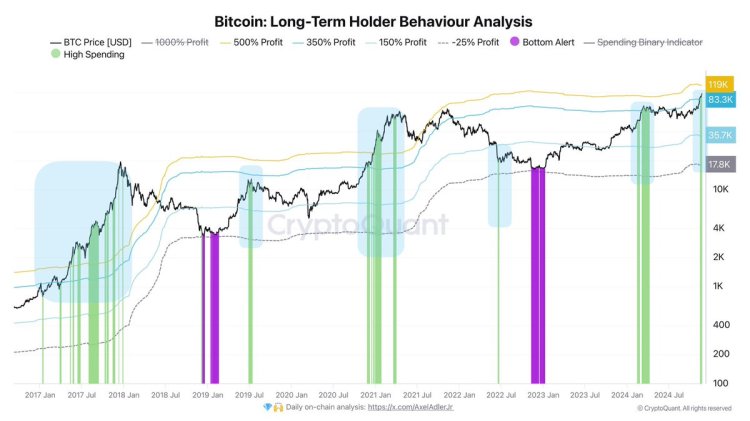

While Bitcoin’s price rise seems unstoppable, on-chain data from CryptoQuant reveals a subtle but significant trend among Long-Term Holders (LTHs). These investors, known for holding large amounts of Bitcoin over extended periods, are beginning to take profits after gains exceeding 350%.

CryptoQuant analyst Axel Adler notes that this behavior could indicate a shift in market dynamics. Historically, LTHs act as stabilizers, limiting selling pressure during rallies. However, their recent activity suggests that some seasoned investors are locking in gains—a potential precursor to a slowdown or even a correction.

Adler points out that if Bitcoin reaches $119,000, LTH profits could soar to over 500%, amplifying selling pressure. While no clear threshold exists to predict a major correction, traders are closely watching for signs of exhaustion in the rally.

Key Levels to Watch: Support and Resistance

As Bitcoin trades at $98,600—just shy of the $100,000 mark—the focus shifts to critical price levels that could determine the next phase of this rally:

$100,000 Resistance: Breaking this psychological barrier could trigger a powerful upward surge, attracting fresh capital and solidifying the bullish trend.

$93,500 Support: Maintaining this level is crucial for sustaining market confidence. A breakdown below this could lead to significant selling pressure.

$85,000 and $80,000 Zones: In the event of a correction, these levels are expected to serve as key demand zones for potential accumulation.

What Lies Ahead for Bitcoin?

The next few days will be pivotal for Bitcoin. If the cryptocurrency breaches $100,000, the rally could accelerate, driven by both momentum and FOMO (fear of missing out). Conversely, a failure to sustain current levels might usher in a period of consolidation, giving the market time to stabilize before resuming its upward trajectory.

For now, traders and investors are advised to remain vigilant. While the optimism surrounding Bitcoin’s six-figure debut is palpable, the interplay between rising demand and profit-taking by long-term holders will shape the market’s near-term direction. Whether Bitcoin surges higher or pauses for breath, its journey remains a defining moment in financial history.