Crypto NEWS

“Ether Set for $3,700 Breakout Despite $1.3B Whale Sell-Off – Here’s Why”

Ether Eyes $3,700 Breakout Despite $1.3 Billion Whale Sell-Off

Ethereum (ETH) is defying market expectations, shrugging off massive selling pressure from long-dormant whales and early investors. With analysts spotting a bullish chart pattern, the cryptocurrency is eyeing a breakout toward $3,700. Here’s a deep dive into the latest developments.

Dormant Whale Unleashes $1.3 Billion in Ether

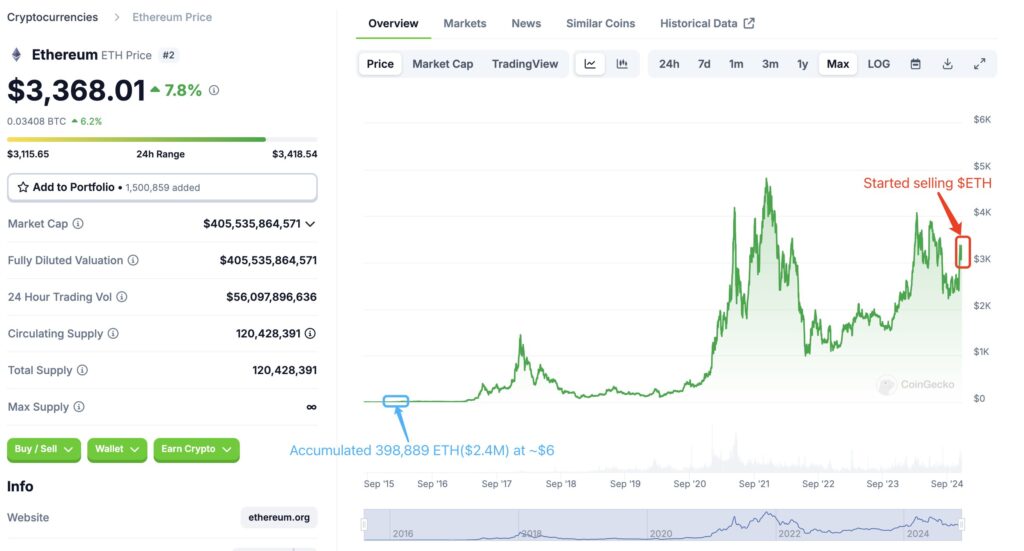

A significant Ether whale has reemerged after over eight years of dormancy, triggering a wave of selling pressure. According to on-chain intelligence firm Lookonchain, this whale accumulated 398,889 ETH at an average price of $6, amounting to a staggering $1.34 billion in holdings.

The whale reactivated on November 7, 2024, following years of inactivity.

Since then, it has sold 73,356 ETH (worth $224.42 million), leaving a remaining balance of 325,533 ETH valued at $1.1 billion.

Despite this, Ether’s price has surged over 7.5% in the past week, trading above $3,369 as of November 22, 2024, according to Cointelegraph.

Early ICO Investors Add to Selling Pressure

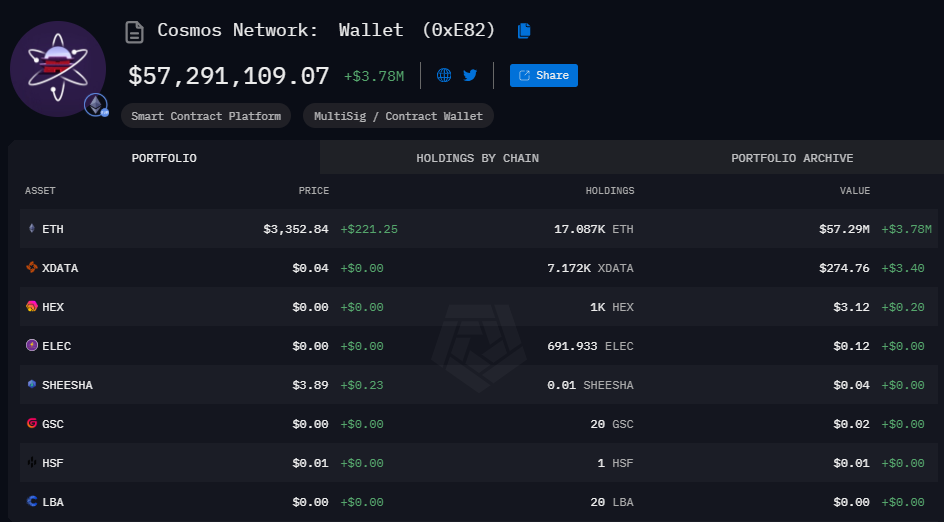

The whale isn’t the only major player offloading Ether. Early Ethereum ICO participant Interchain, known for its involvement in the Cosmos Network, has also been liquidating its holdings.

On November 22, 2024, Interchain sold 3,000 ETH worth $10.1 million.

Since April 2024, the entity has sold 21,600 ETH, worth over $95 million, at an average price of $2,591.

Despite the sales, the wallet still holds 17,000 ETH valued at $57 million, per Arkham Intelligence data.

These large-scale sell-offs typically put downward pressure on prices, but Ether has shown surprising resilience.

Bull Flag Pattern Signals a Breakout

While whales are creating turbulence, Ether’s price action is forming a bull flag, a classic bullish chart pattern indicating an impending rally.

Pseudonymous analyst Rekt Capital highlighted the pattern in a November 21 post, noting:

> “Ethereum is currently breaking out from its short-term Bull Flag. Confirmed breakout would see ETH revisit the ~$3,700 resistance above.”

This bullish sentiment aligns with broader market trends, as Bitcoin (BTC) crossed the $99,000 mark on November 22, achieving its best monthly performance in crypto history with a 40% surge in November. Ether’s historical correlation with Bitcoin has many investors anticipating a similar rally.

Can Ether Reclaim $3,700?

Despite the heavy selling pressure, Ether’s fundamentals remain robust. Its ability to withstand whale activity and early investor sell-offs underscores the growing confidence among market participants.

As the bull flag pattern unfolds and Bitcoin’s momentum continues, Ether seems poised to test the $3,700 resistance level, marking a significant milestone on its path toward reclaiming its all-time high.

For now, all eyes are on the charts as Ethereum continues to prove its resilience in an evolving market.