Crypto NEWS

“Bitcoin Skyrockets to $94,000: Is $100K Closer Than We Think?”

Bitcoin Hits All-Time High of $94,000: What’s Driving the Surge?

Bitcoin (BTC) has reached a new all-time high, soaring to $94,000 and cementing the bulls’ dominance in the market. This milestone has sparked discussions across the financial world, with experts dissecting the forces behind the rally. Let’s dive into the key drivers propelling Bitcoin’s latest surge and what it means for the cryptocurrency’s future.

The Role of U.S.-Based Investors

According to Ki Young Ju, CEO of CryptoQuant, the recent rally has been heavily influenced by U.S. market participants, particularly those trading on Coinbase. Ju highlighted the BTC Hourly Coinbase Premium, a metric that reflects the price difference between Bitcoin on Coinbase and other exchanges. Currently, the premium is positive and increasing, signaling strong domestic demand.

This trend suggests that American investors are paying a premium for Bitcoin, driven by improving market sentiment and potential regulatory optimism. The pro-crypto stance of President-elect Donald Trump has further amplified this enthusiasm, with industry players hopeful for a favorable regulatory environment under his leadership.

What This Means for the Market

The robust demand from U.S. investors underscores their growing influence on global crypto trends. If this momentum continues, Bitcoin could sustain its upward trajectory, potentially setting new records before any significant corrections occur.

Bitcoin Demand Outpaces Supply Despite Profit-Taking

Bitcoin’s bullish momentum persists even as miners and long-term holders (LTHs) capitalize on the rally by taking profits. This resilience highlights the strength of market demand, as buyers continue to absorb the distributed supply.

Ju’s analysis on X (formerly Twitter) emphasizes this dynamic, noting that U.S.-based investors are driving the surge. The willingness of these buyers to pay a premium reinforces Bitcoin’s current strength, suggesting that demand is outpacing selling pressure.

The Road Ahead

If U.S. demand remains strong, Bitcoin could extend its rally further in the coming weeks. However, the market is aware of the potential for pullbacks, as all parabolic trends eventually face corrections. Traders are watching closely to see whether Bitcoin can maintain its momentum or if a consolidation phase is imminent.

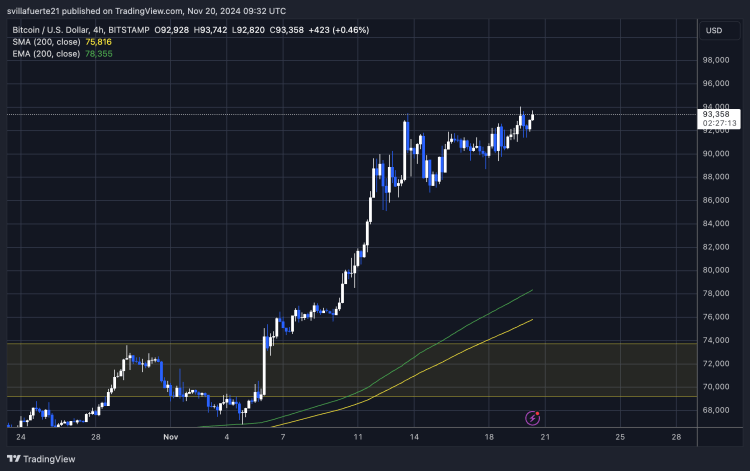

BTC Maintains Momentum Above Key Support Levels

After briefly reaching $94,000, Bitcoin is currently trading at $93,300, consolidating near its new all-time high (ATH). This sideways movement within a broader uptrend suggests that demand continues to outweigh supply. However, the breakout above the previous ATH lacked significant momentum, raising questions about the bulls’ staying power.

Critical Support at $89,800

For Bitcoin to continue its ascent, it must hold above the key support level of $89,800. Successfully maintaining this level could pave the way for a surge to $95,000, aligning with expectations of sustained bullish momentum. Such a move would bolster investor confidence and set the stage for Bitcoin to approach the psychological $100,000 milestone.

Risks of a Pullback

A drop below $89,800, however, could shift the narrative. This scenario might lead to a retracement toward lower demand zones around $85,000, where buyers could regroup for another push higher. As Bitcoin consolidates near its ATH, the market remains on edge, awaiting a decisive move to confirm whether the bulls retain control or if a temporary correction is on the horizon.

Final Thoughts

Bitcoin’s historic surge to $94,000 underscores its resilience and the strong appetite from U.S. investors. While optimism surrounding regulatory changes and bullish sentiment fuels the rally, traders remain cautious, mindful of potential corrections. The coming days will be critical in determining whether Bitcoin can sustain its momentum or if the market is due for a pause.

For now, Bitcoin’s march toward $100,000 seems increasingly plausible, with demand outpacing supply and market enthusiasm showing no signs of waning. As the cryptocurrency continues to break barriers, all eyes remain on the charts for the next big move.